Part 1: When a company acquires another company, often less than 100% of the shares are acquired.

Question:

Part 1: When a company acquires another company, often less than 100% of the shares are acquired. For an acquisition to be considered a business acquisition, control must be obtained. Net income of the acquired company is divided between the controlling and non- controlling interest.

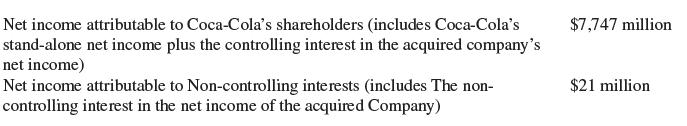

The following information is from Coca- Cola Company’s 2020 annual report.

Required:

A. If the economic entity concept is followed, consolidated net income would be what dollar amount?

B. If the parent company concept is followed, consolidated net income would be what amount?

Part 2:

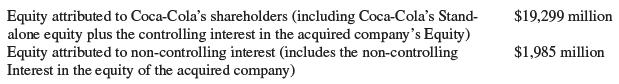

On Coca- Cola Company’s 2020 balance sheet, the standalone equity of Coca- Cola is presented along with the equity of any acquired company (this amount is separated into the controlling interest owned by Coca- Cola and the non- controlling interest owned by entities other than Coca- Cola). The following information is known:

C. If the economic entity concept is followed, Consolidated equity would be:

D. If the parent company concept is followed, consolidated equity would be what amount?

Step by Step Answer: