Question:

Sequoia Sport Apparel is a retail store with two departments: Clothing and Shoes. The general ledger and accounts receivable ledger are included in your Working Papers. The balances are recorded as of April 1 of the current year.

Instructions:

1. Journalize the transactions for April of the current year. Use page 4 of a sales journal and page 6 of a general journal. The sales tax rate is 5%. Source documents are abbreviated as follows: credit memorandum, CM; sales invoice, S.

2. Prove and rule the sales journal. Post the totals to the general ledger.

Transcribed Image Text:

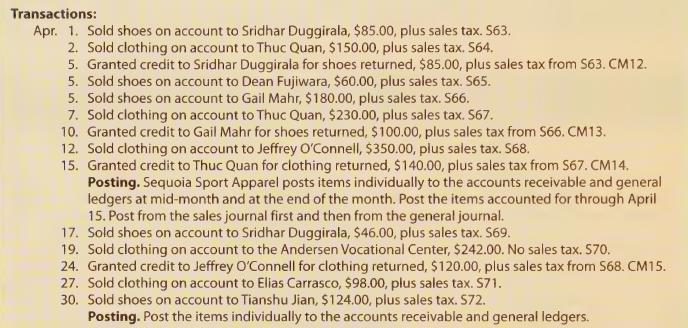

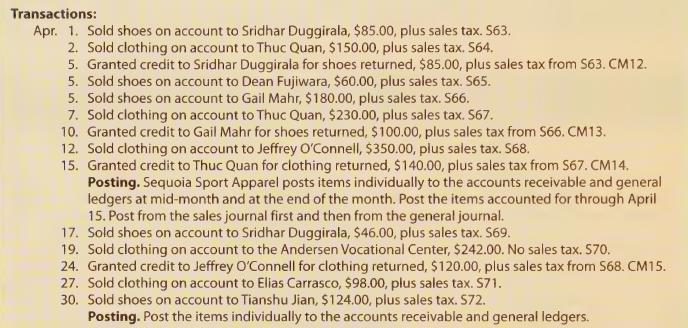

Transactions: Apr. 1. Sold shoes on account to Sridhar Duggirala, $85.00, plus sales tax. 563. 2. Sold clothing on account to Thuc Quan, $150.00, plus sales tax. 564. 5. Granted credit to Sridhar Duggirala for shoes returned, $85.00, plus sales tax from S63. CM12. 5. Sold shoes on account to Dean Fujiwara, $60.00, plus sales tax. S65. 5. Sold shoes on account to Gail Mahr, $180.00, plus sales tax. 566. 7. Sold clothing on account to Thuc Quan, $230.00, plus sales tax. 567. 10. Granted credit to Gail Mahr for shoes returned, $100.00, plus sales tax from S66. CM13. 12. Sold clothing on account to Jeffrey O'Connell, $350.00, plus sales tax. S68. 15. Granted credit to Thuc Quan for clothing returned, $140.00, plus sales tax from S67. CM14. Posting. Sequoia Sport Apparel posts items individually to the accounts receivable and general ledgers at mid-month and at the end of the month. Post the items accounted for through April 15. Post from the sales journal first and then from the general journal. 17. Sold shoes on account to Sridhar Duggirala, $46.00, plus sales tax. $69. 19. Sold clothing on account to the Andersen Vocational Center, $242.00. No sales tax. 570. 24. Granted credit to Jeffrey O'Connell for clothing returned, $120.00, plus sales tax from S68. CM15. 27. Sold clothing on account to Elias Carrasco, $98.00, plus sales tax. S71. 30. Sold shoes on account to Tianshu Jian, $124.00, plus sales tax. S72. Posting. Post the items individually to the accounts receivable and general ledgers.