Stockholders of Acme Company, Baltic Company, and Colt Company are considering alternative arrangements for a business combination.

Question:

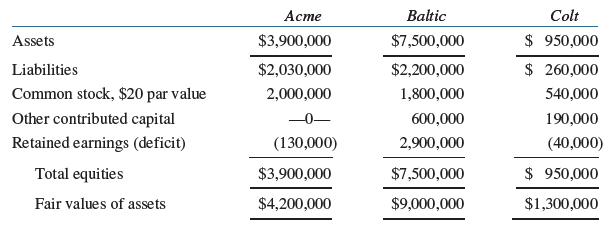

Stockholders of Acme Company, Baltic Company, and Colt Company are considering alternative arrangements for a business combination. Balance sheets and the fair values of each company’s assets on October 1, 2024, were as follows:

Acme Company shares have a fair value of $50. A fair (market) price is not available for shares of the other companies because they are closely held. Fair values of liabilities equal book values.

Required:

A. Prepare a balance sheet for the business combination. Assume the following: Acme Company acquires all the assets and assumes all the liabilities of Baltic and Colt Companies by issuing in exchange 140,000 shares of its common stock to Baltic Company and 40,000 shares of its common stock to Colt Company.

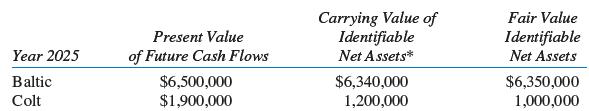

B. Assume, further, that the acquisition was consummated on October 1, 2024, as described above. However, by the end of 2025, Acme was concerned that the fair values of one or both of the acquired units had deteriorated. To test for impairment, Acme decided to measure goodwill impairment using the present value of future cash flows to estimate the fair value of the reporting units (Baltic and Colt). Acme accumulated the following data:

Prepare the journal entry, if needed, to record goodwill impairment at December 31, 2025. Use FASB’s simplified approach to test for goodwill impairment (assume that the qualitative test is satisfied or bypassed).

Step by Step Answer: