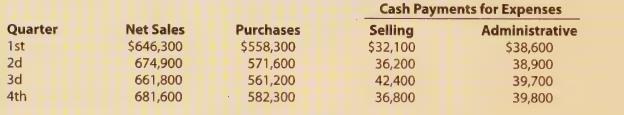

The following table shows SeaWest Fabrications projected net sales, purchases, and cash payments for expenses for 20X3.

Question:

The following table shows SeaWest Fabrication’s projected net sales, purchases, and cash payments for expenses for 20X3.

Additional information is as follows:

a. Actual amounts for the fourth quarter of 20X2: sales, \($639,200;\) purchases, \($548,240.\)

b. The balance of cash on hand on January 1, 20X3, is \($35,720.\)

c. In each quarter, cash sales are 10.0% and collections of accounts receivable are 50.0% of the projected net sales for the current quarter. Collections from the preceding quarter's net sales are 39.5% of that quarter.

Uncollectible accounts expense is 0.5% of net sales.

d. In each quarter, cash payments for cash purchases are 10.0% and for accounts payable 30.0% of the purchases for the current quarter. Cash payments for purchases of the preceding quarter are 60.0% of that quarter.

e. Record only total projected cash payments for expenses as shown in the table above.

f. In the second quarter, SeaWest will borrow \($35,000\) on a promissory note and will purchase equipment costing \($31,600\) for cash. In the third quarter dividends of \($30,000\) will be paid in cash. In the fourth quarter, the promissory note plus interest will be paid in cash, \($37,500.\)

g. Equal quarterly income tax payments are based on projected annual federal income tax expense of \($7,720.\)

Instructions:

1. Prepare a cash receipts budget schedule (Schedule A) for the four quarters ended December 31, 20X3.

Round all amounts to the nearest \($10.\)

2. Prepare a cash payments budget schedule (Schedule B) for the four quarters ended December 31, 20X3.

3. Prepare a cash budget for the four quarters ended December 31, 20X3.

Step by Step Answer: