Question:

The town of Mabank uses a general fund for all financial transactions. Expenditures are recorded by type of expenditure and by departmentT.he four categories of expenditures are personnel, supplies, other charges, and capital outlays. Departments are General Government, Public Safety, Fire Protection, and Recreation.

Instructions:

Journalize the transactions for the current year. Use page 1 of a journal.

Transcribed Image Text:

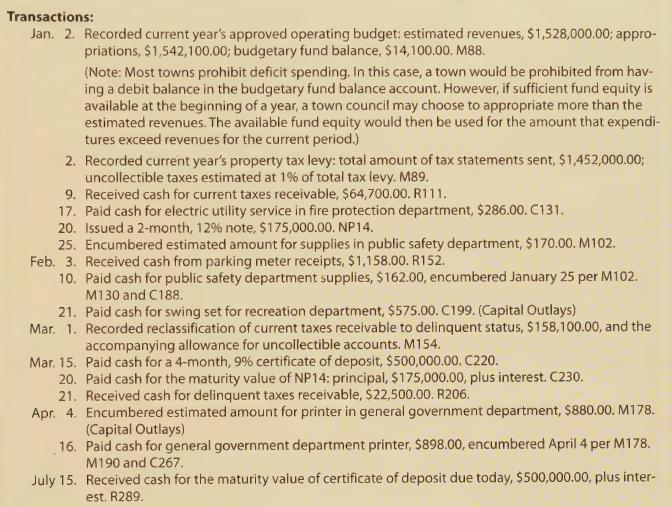

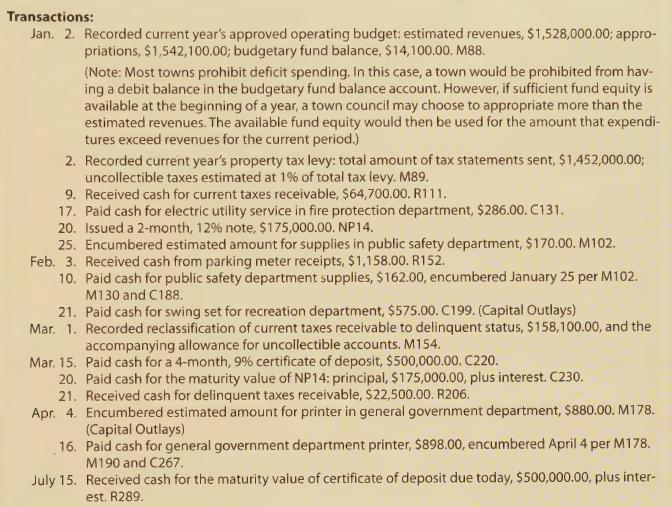

Transactions: Jan. 2. Recorded current year's approved operating budget: estimated revenues, $1,528,000.00; appro- priations, $1,542,100.00; budgetary fund balance, $14,100.00. M88. (Note: Most towns prohibit deficit spending. In this case, a town would be prohibited from hav- ing a debit balance in the budgetary fund balance account. However, if sufficient fund equity is available at the beginning of a year, a town council may choose to appropriate more than the estimated revenues. The available fund equity would then be used for the amount that expendi- tures exceed revenues for the current period.) 2. Recorded current year's property tax levy: total amount of tax statements sent, $1,452,000.00; uncollectible taxes estimated at 1% of total tax levy. M89. 9. Received cash for current taxes receivable, $64,700.00. R111. 17. Paid cash for electric utility service in fire protection department, $286.00. C131. 20. Issued a 2-month, 12% note, $175,000.00. NP14. 25. Encumbered estimated amount for supplies in public safety department, $170.00. M102. Feb. 3. Received cash from parking meter receipts, $1,158.00. R152. 10. Paid cash for public safety department supplies, $162.00, encumbered January 25 per M102. M130 and C188. 21. Paid cash for swing set for recreation department, $575.00. C199. (Capital Outlays) Mar. 1. Recorded reclassification of current taxes receivable to delinquent status, $158,100.00, and the accompanying allowance for uncollectible accounts. M154. Mar. 15. Paid cash for a 4-month, 9% certificate of deposit, $500,000.00. C220. 20. Paid cash for the maturity value of NP14: principal, $175,000.00, plus interest. C230. 21. Received cash for delinquent taxes receivable, $22,500.00. R206. Apr. 4. Encumbered estimated amount for printer in general government department, $880.00. M178. (Capital Outlays) 16. Paid cash for general government department printer, $898.00, encumbered April 4 per M178. M190 and C267. July 15. Received cash for the maturity value of certificate of deposit due today, $500,000.00, plus inter- est. R289.