The town of Plymouth uses a general fund. The trial balance for December 31 of the current

Question:

The town of Plymouth uses a general fund. The trial balance for December 31 of the current year is recorded on a work sheet in the Working Papers. The following adjustment information is available.

An estimated 20% of the interest revenue due will not be collected.

The reserve for encumbrances for the current year is reclassified to prior year status.

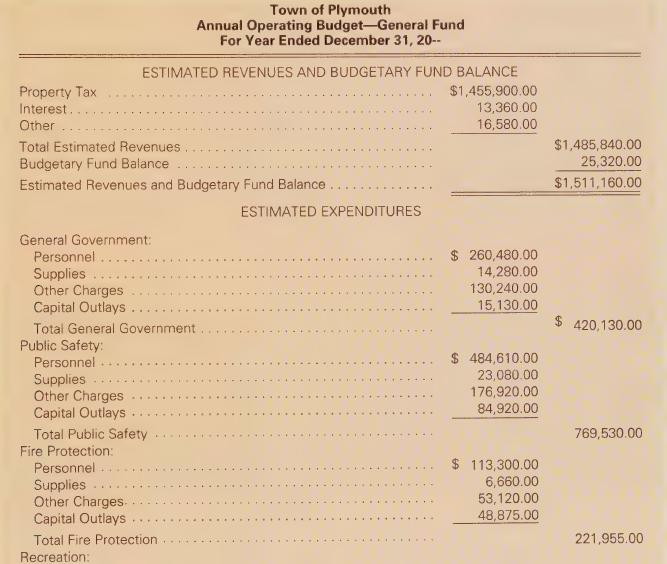

Plymouth’s general fund operating budget for the current fiscal year is shown as follows.

Plymouth’s town council permits departmental managers to exceed budgeted amounts for supplies, other charges, and capital outlays. However, total amounts expended for these three types of expenditure must be within the total budget amounts for these three items within each department.

Plymouth is prohibited from deficit spending. However, if sufficient funds are on hand at the beginning of a year, the town council may choose to appropriate more than the estimated revenues. Sufficient funds are on hand when the beginning fund balance plus estimated revenues equals or exceeds appropriations.

Instructions:

1. Analyze the adjustment information and record the adjustments on the work sheet.

2. Complete the work sheet.

3. Prepare a statement of revenues, expenditures, and changes in fund balance—budget and actual for the year ended December 31 of the current year. The unreserved fund balance on January 1 was $63,450.00.

4, Prepare a balance sheet for December 31 of the current year.

5. Use page 40 of a journal. Journalize the adjusting entries.

6. Continue using page 40 of the journal. Journalize the closing entries.

Step by Step Answer: