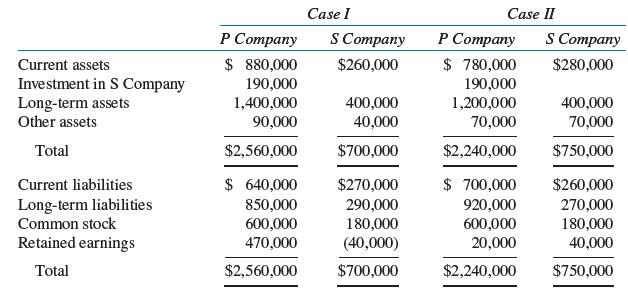

The two following separate cases show the financial position of a parent company and its subsidiary company

Question:

The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2024, just after the parent had purchased 90% of the subsidiary’s stock:

Required:

A. Prepare a November 30, 2024, consolidated balance sheet workpaper for each of the foregoing cases. In Case I, any difference between the book value of equity and the value implied by the purchase price relates to subsidiary long- term assets. In Case II, assume that any excess of book value over the value implied by purchase price is due to overvalued long- term assets.

B. Assume that Company S’s balance sheet is the same as the balance sheet used in Case I (from part A). Suppose that there were 50,000 shares of S Company common stock out-standing and that Company P acquired 90% of the shares for $4.50 a share. Shortly after the

acquisition, the noncontrolling shares were selling for $4.25 a share. Prepare a computation and allocation of difference schedule considering this information.

Step by Step Answer: