Use the work sheet prepared in Application Problem 13-1. Instructions: 1. Prepare an income statement for the

Question:

Use the work sheet prepared in Application Problem 13-1.

Instructions:

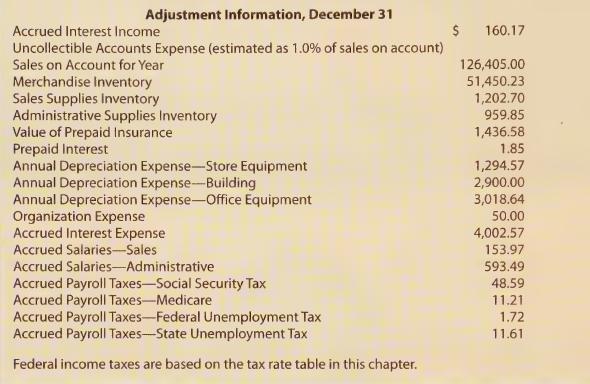

1. Prepare an income statement for the current year ended December 31.

2. Calculate and record the following component percentages:

(a) cost of merchandise sold,

(b) gross profit on operations,

(c) total selling expenses,

(d) total administrative expenses,

(e) total operating expenses,

(f) income from operations,

(g) net addition or deduction resulting from other revenue and expenses,

(h) net income before federal income tax,

(i) federal income tax expense,

(j) net income after federal income tax.

Round the percentage calculations to the nearest 0.1%.

3. Use the Income Statement Analysis table given in the Working Papers. Analyze Trexler’s income statement by determining whether component percentages are within acceptable levels. If any component percentage is not within an acceptable level, suggest steps that the company should take.

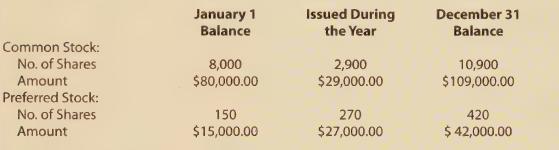

4. Calculate earnings per share. Round the calculation to the nearest cent. Trexler has 10,900 shares of \($10.00\) stated-value common stock issued and 420 shares of \($100.00\) par-value preferred stock issued. Treasury stock consists of 70 shares of common stock. The dividend rate on preferred stock is 10%.

5. Prepare a statement of stockholders’ equity for the current year ended December 31. Use the following additional information.

Treasury stock consists of 70 shares of common stock.

The January 1 balance of Retained Earnings was \($13,411.26.\)

6. Calculate the following items:

(a) equity per share of stock and

(b) price-earnings ratio. The market price of common stock on December 31 is \($24.00.\)

7. Prepare a balance sheet for December 31 of the current year.

8. Calculate the following items:

(a) Accounts receivable turnover ratio. Net sales on account are \($126,405.00.\) Accounts receivable and allowance for uncollectible accounts on January 1 were \($26,495.72\) and \($1,142.37,\) respectively.

(b) Rate earned on average stockholders’ equity. Total stockholders’ equity on January 1 was \($106,951.26.\)

(c) Rate earned on average total assets. Total assets on January 1 were \($233,699.75.

Data\) from Application Problem 13-1.

General ledger account titles and balances for Trexler, Inc., are recorded on a work sheet in the Working Papers accompanying this textbook. Complete the work sheet for the current year ended December 31. Record the adjustments on the work sheet using the following information.

Step by Step Answer: