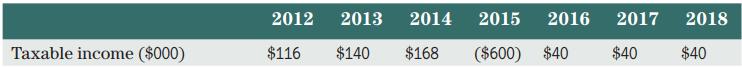

The Stayner Company experienced an operating loss of $4,100,000 in 2015. Taxable income figures for recent years

Question:

The Stayner Company experienced an operating loss of $4,100,000 in 2015. Taxable income figures for recent years are given below. Show how the firm can maximize its tax refunds.

Transcribed Image Text:

Taxable income ($000) 2012 2013 2014 2015 $116 2016 2017 $140 $168 ($600) $40 $40 2018 $40

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (15 reviews)

Carry the 600 loss in 2015 back 3 years and the remaining ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781259654756

10th Canadian Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan, Gordon Roberts, J. Ari Pandes, Thomas Holloway

Question Posted:

Students also viewed these Business questions

-

The Stayner Company experienced an operating loss of $4,100,000 in 2009. Taxable income figures for recent years are given below. Show how the firm can maximize its tax refunds. 2007 $140 2009 2012...

-

Tobac Company reported an operating loss of $60,000 for financial reporting and tax purposes in 2019. The tax rate is 30% for 2019. Assume that Tobac elects a loss carryforward. Taxable incomes and...

-

Wynn Sheet Metal reported an operating loss of $100,000 for financial reporting and tax purposes in 2011. The enacted tax rate is 40%. Taxable income, tax rates, and income taxes paid in Wynn's first...

-

Randi Corp. is considering the replacement of some machinery that has zero book value and a current market value of $3,700. One possible alternative is to invest in new machinery that costs $30,900....

-

We wish to estimate a two-sided natural tolerance interval that will include 99% of the values of a random variable with probability 0.80. If nothing is known about the distribution of the random...

-

On the first day of the fiscal year, a company issues a $1,800,000, 6%, five-year bond that pays semiannual interest of $54,000 ($1,800,000 3 6% 3 ), receiving cash of $1,725,151. Journalize the...

-

(Entries for Retirement and Issuance of Bonds) Matt Perry, Inc. had outstanding $6,000,000 of 11% bonds (interest payable July 31 and January 31) due in 10 years. On July 1, it issued $9,000,000 of...

-

Prepare a master budget for McGregor Pharmacy Company for the year ending December 31, 2021 using the following information. Prepare it per quarter. Use the tables provided by the professor. Fill it....

-

Duke Energy's capital structure is comprised of 29% debt and no preferred stock; the rest of their capital is in the form of common stock. The cost of debt for Duke Energy is 3%, and the cost of...

-

Let H- be a parity check matrix, determine the (3,6) group code, 00 B*.

-

In recent years, Cheticamp Co. has greatly increased its current ratio. At the same time, the quick ratio has fallen. What has happened? Has the liquidity of the company improved?

-

Kanata Construction specializes in large projects in Edmonton and Saskatoon. In 2017, Kanata invested $1.5 million in new excavating equipment, which qualifies for a CCA rate of 50%. At the same time...

-

The velocity ratio of third system of pulleys is 2 n 1. True or False

-

Account is a domestic growth portfolio. The current holdings are primarily US exchange-traded stocks and bonds. To remain in compliance, the total portfolio may only invest up to a maximum of 5% in...

-

The President of the United States needs your help. He has asked you to investigate and find answers to several important questions. His questions are included in the Letter from the President below....

-

Cheng Co. reports the following information for the coming year. Labor rate, including fringe benefits Annual labor hours Annual materials purchases Annual overhead costs: Materials purchasing,...

-

Compared to most objects, sound waves travel very fast. It is fast enough that measuring the speed of sound is a technical challenge. One method you could use would be to time an echo. For example,...

-

Sharif and Judith are married and purchased a vacation home together in Maine for $ 2 5 0 , 0 0 0 . Sharif died suddenly six months later and at that time the fair market value of the vacation home...

-

Describe a process for finding the slope of the line tangent to the graph of f at (a, f(a)).

-

Suppose you need to answer any four of seven essay questions on a history test and you can answer them in any order. a. How many different question combinations are possible? b. What is the...

-

Why might the revenue and cost figures shown on a standard income statement not be representative of the actual cash inflows and outflows that occurred during a period?

-

In preparing a balance sheet, why do you think standard accounting practice focuses on historical cost rather than market value?

-

In preparing a balance sheet, why do you think standard accounting practice focuses on historical cost rather than market value?

-

Your company BMG Inc. has to liquidate some equipment that is being replaced. The originally cost of the equipment is $120,000. The firm has deprecated 65% of the original cost. The salvage value of...

-

1. What are the steps that the company has to do in time of merger transaction? And What are the obstacle that may lead to merger failure? 2.What are the Exceptions to not to consolidate the...

-

Problem 12-22 Net Present Value Analysis [LO12-2] The Sweetwater Candy Company would like to buy a new machine that would automatically "dip" chocolates. The dipping operation currently is done...

Study smarter with the SolutionInn App