You are short a put option on Oracle stock with an exercise price of $20 that expires

Question:

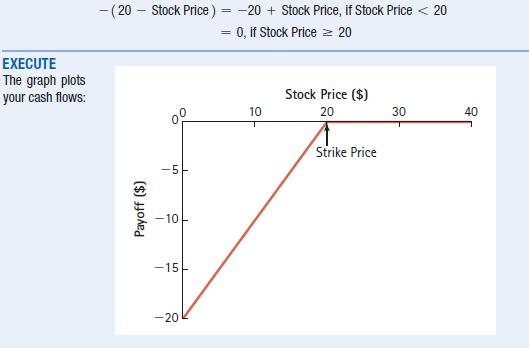

You are short a put option on Oracle stock with an exercise price of $20 that expires today. Plot the value of this option as a function of the stock price.

SOLUTION PLAN Again, the strike price is $20 and in this case your cash flows will be opposite of those from Eq. 21.2, as depicted in the previous example. Thus, your cash flows will be

EVALUATE If the current stock price is $30, the put will not be exercised and you will owe nothing. If the current stock price is $15, the put will be exercised and you will lose $5. Comparing the graph here and in Example 21.2, we see that the payoffs are mirror images of each other.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781292437156

5th Global Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Question Posted: