What is the risk-free interest rate for a five-year maturity? The current zero-coupon yield curve for risk-free

Question:

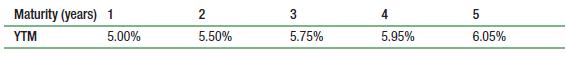

What is the risk-free interest rate for a five-year maturity? The current zero-coupon yield curve for risk-free bonds is as follows:

Maturity (years) 1 YTM 5.00% 2 5.50% 3 5.75% 4 5.95% LO 5 6.05%

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9780135811603

5th Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

(4p) Assume the interest rate of a three-year maturity zero-coupon bond is 7.5% and a five-year bond is 9.5%. What is the expected interest rate between year three and five if you are considering:...

-

To insure a stock portfolio against price decreases, owners of stock portfolios should a on the stock index? A call option with a strike price of Rs55 can be bought for Rs4. What will be your net...

-

Last Sale Net Bid Ask Open Int Puts Last Sale Net bid Ask Vol Open Int 16Aug 155.00(1619H155-E) 6.45 0.75 6.95 7.25 9 16Aug 155.00(1619T155-E) 1.18 (0.75) 1.17 1.25 61 4505 16Aug 166.00(1619H160-E)...

-

1. Find the probability of obtaining between 40 and 60 heads when tossing a coin 100 times. 2. Find the probability of obtaining 6s between 20 and 40 times when rolling a die 200 times.

-

For the Gas prices: a) Find a 2-point moving average of the first year. b) Use it to predict the value for January 2007. Month Apples Gas Jan Feb Mar 0.935 2444 Apr 0958 2.801 May 1021 2.993 Jun Jul...

-

Describe alternatives to job-based pay.

-

4. The International Journal of Project Management is an IPMA publication. Go to the journals home page or go to the website of Elsevier Science Direct and search for the journal. Click on the Free...

-

On December 31, 2015, analysis of Sayer Sporting Goods' operations for 2015 revealed the following. (a) Total cash collections from customers, $105,260. (b) December 31, 2014, inventory balance,...

-

from the chapter, fol- 6.e., control goals P 7-3 control responsum Following is a list of eight generic control goals from the chanta lowed by eight descriptions of either process failures (i.e.,...

-

Anzio, Inc., has two classes of shares. Class B has 10 times the voting rights as Class A. If you own 10% of the class A shares and 20% of the Class B shares, what percentage of the total voting...

-

You just purchased a share of SPCC for $100. You expect to receive a dividend of $5 in one year. If you expect the price after the dividend is paid to be $110, what total return will you have earned...

-

Why is diversification in the shareholders interest? Should the company diversify? If so, under what circumstances should it do so?

-

Drs. Draper and Keys run a partnership family medical practice in Brownsville, Texas. While the practice is profitable, both physicians are making payments on heavy debt loads for student loans that...

-

Sweetlip Ltd and Warehou Ltd are two family-owned flax-producing companies in New Zealand. Sweetlip Ltd is owned by the Wood family and the Bradbury family owns Warehou Ltd. The Wood family has only...

-

Small Sample Weights of M&M plain candies are normally distributed. Twelve M&M plain candies are randomly selected and weighed, and then the mean of this sample is calculated. Is it correct to...

-

Swain Athletic Gear (SAG) operates six retail outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city....

-

The Tokyo Olympics After watching How the Tokyo Olympics Became the Most Expensive Summer Game Ever video answer the following questions. * * The numbers can be made up . I just need help with an...

-

Suppose that the conical tank in Problem 13(a) is inverted, as shown in the following figure, and that water leaks out a circular hole of radius 2 inches in the center of its circular base. Is the...

-

The time to assemble the first unit on a production line is 10 hours. The learning rate is 0.94. Approximately how long will it take for the seventh unit to be assembled? The number of hours needed...

-

Under what assumptions can the WACC be used to value a project?

-

What possible problems might be associated with the assumptions used in applying the WACC method?

-

How should you value a project in a line of business with risk that is different than the average risk of your firm's projects?

-

As a Financial Analyst in the Finance Department of Zeta Auto Corporation they are seeking to expand production. The CFO asks you to help decide whether the firm should set up a new plant to...

-

Chapter 4 When an Auditor finds misstatements in entities financial statements which may be the result of fraudulent act, what should be the role of an auditor under that situation? (2 Points)

-

Suppose the following input prices are provided for each year: Required: $

Study smarter with the SolutionInn App