You are currently considering making an investment in the fast food industry. You determine the project has

Question:

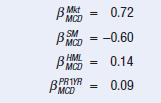

You are currently considering making an investment in the fast food industry. You determine the project has the same level of non-diversifiable risk as investing in McDonald’s stock. You use data over the past nine years to estimate the factor betas of McDonald’s stock (ticker symbol: MCD). Specifically, you regress the monthly excess return (the realized return in each month minus the risk-free rate) of McDonald’s stock on the return of each of the four-factor portfolios. You determine that the factor betas for MCD are:

The current risk-free monthly rate is 2.4%/12 = 0.2%. Determine the cost of capital by using the FFC factor specification.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780137852581

6th Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Question Posted: