1 How much of the information which he had gathered was really relevant to the decision? Roger...

Question:

1 How much of the information which he had gathered was really relevant to the decision? Roger Davis, the newly appointed financial analyst of the Steel Tube division of Engineering Products plc, shut his office door and walked over to his desk. He had just 24 hours to re-examine the accountant’s profit projections and come up with a recommendation on the proposed new computer numerically controlled (CNC) milling machine.

At the meeting he had just left, the managing director made it quite clear: ‘If the project can’t pay for itself in the first three years, it’s not worth bothering with.’ Davis was unhappy with the accountant’s analysis which showed that the project was a loss maker. But as the MD said, ‘Unless you can convince me by this time tomorrow that spending £240,000 on this capital project makes economic sense, you can forget the whole idea.’

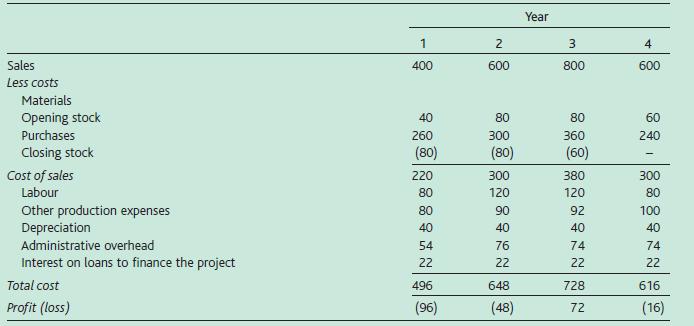

His first task was to re-examine the accountant’s profitability forecast (Table 6.11) in the light of the following facts that emerged from the meeting:

1 Given the rapid developments in the market, it was unrealistic to assume that the product had more than a four-year life. The machinery would have no other use and could not raise more than £20,000 in scrap metal at the end of the project.

2 The opening stock in Year 1 would be acquired at the same time as the machine. All other stock movement would occur at the year ends.

3 This type of machine was depreciated over six years on a straight-line basis.

4 Within the ‘other production expenses’ were apportioned fixed overheads equal to 20 per cent of labour costs.

As far as could be seen, none of these overheads were incurred as a result of the proposal.

5 The administration charge was an apportionment of central fixed overheads.

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale