17. Currency Risk. You have bid for a possible export order that would provide a cash inflow...

Question:

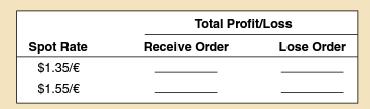

17. Currency Risk. You have bid for a possible export order that would provide a cash inflow of 1 million in 6 months. The spot exchange rate is $1.45/, and the 1-year forward rate is $1.43/. There are two sources of uncertainty: (1) The euro could appreciate or depreciate, and (2) you may or may not receive the export order. Illustrate in each case the profits or losses that you would make if you sell 1 million forward by filling in the following table. Assume that the exchange rate in 1 year will be either $1.35/ or $1.55/. (LO3)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780073382302

6th Edition

Authors: Richard A Brealey, Stewart C Myers, Alan J Marcus

Question Posted: