21. Project Evaluation. Revenues generated by a new fad product are forecast as follows: Expenses are expected

Question:

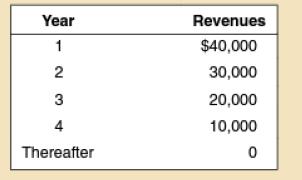

21. Project Evaluation. Revenues generated by a new fad product are forecast as follows:

Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $45,000 in plant and equipment. (LO2)

Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $45,000 in plant and equipment. (LO2)

a. What is the initial investment in the product? Remember working capital.

b. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight- line depreciation, and the firm's tax rate is 40%, what are the project cash flows in each year?

c. If the opportunity cost of capital is 12%, what is project NPV?

d. What is project IRR?

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9780073382302

6th Edition

Authors: Richard A Brealey, Stewart C Myers, Alan J Marcus