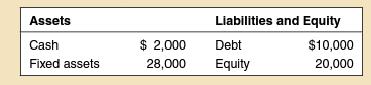

23. Dividends versus Repurchases. Big Industries has the following market-value balance sheet. The stock currently sells for

Question:

23. Dividends versus Repurchases. Big Industries has the following market-value balance sheet. The stock currently sells for $20 a share, and there are 1,000 shares outstanding. The firm will either pay a $1 per share dividend or repurchase $1,000 worth of stock. Ignore taxes. (LO4)

a. What will be the price per share under each alternative (dividend versus repurchase)?

b. If total earnings of the firm are $2,000 a year, find earnings per share under each alternative.

c. Find the price-earnings ratio under each alternative.

d. Adherents of the "dividends-are-good" school sometimes point to the fact that stocks with high-dividend-payout ratios tend to sell at above-average price-earnings multiples. Is this evidence convincing? Discuss this argument with regard to your answers to parts

(a) to (c).

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9780073382302

6th Edition

Authors: Richard A Brealey, Stewart C Myers, Alan J Marcus