29. Multiple IRR. Consider the following cash flows: (LO2) a. Confirm that one internal rate of return

Question:

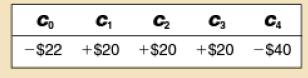

29. Multiple IRR. Consider the following cash flows: (LO2)

a. Confirm that one internal rate of return on this project is (a shade above) 7%, and that the other is (a shade below) 34%.

b. Is the project attractive if the discount rate is 5%?

c. What if it is 20%? 40%?

d. Why is the project attractive at midrange discount rates but not at very high or very low rates?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780073382302

6th Edition

Authors: Richard A Brealey, Stewart C Myers, Alan J Marcus

Question Posted: