3 Dangara plc is contemplating a takeover bid for another quoted company, Tefor plc. Both companies are

Question:

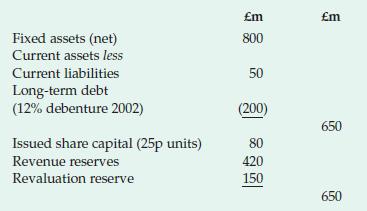

3 Dangara plc is contemplating a takeover bid for another quoted company, Tefor plc. Both companies are in the leisure sector, operating a string of hotels, restaurants and motorway service stations. Tefor’s most recent Balance Sheet shows the following:

Tefor has just reported full-year profits of £200 m after tax.

You are provided with the following further information:

(a) Dangara’s shareholders require a return of 14 per cent.

(b) Dangara would have to divest certain of Tefor’s assets, mainly motorway service stations, to satisfy the competition authorities. These assets have a book value of £100 million, but Dangara thinks they could be sold on to Lucky Break plc for £200 million.

(c) Tefor’s assets were last revalued in 1992, at the bottom of the property market slump.

(d) Dangara’s P:E ratio is 14:1, Tefor’s is 10:1.

(e) Tefor’s earnings have risen by only 2 per cent p.a. on average over the previous five years, while Dangara’s have risen by 7 per cent p.a. on average.

(f) Takeover premiums (i.e. amount paid in excess of pre-bid market values) have recently averaged 20 per cent across all market sectors.

(g) Many ‘experts’ believe that a stock market ‘correction’ is imminent, due to the likelihood of a new government, led by Bony Clair, being elected. The new government would possibly adopt a more stringent policy on competition issues.

(h) If a bid is made, there is a possibility that the Chairman of Tefor will make a counter-offer to its shareholders to attempt to take the company off the Stock Exchange.

(i) If the bid succeeds, Tefor’s ex-chairman is expected to offer to repurchase a major part of the hotel portfolio.

(j) Much of Tefor’s hotel asset portfolio is rather shabby and requires refurbishments, estimated to cost some million p.a. for the next five years.

Required As strategic planning analyst, you are instructed to prepare a briefing report for the main board, which:

(i) assesses the appropriate value to place on Tefor, using suitable valuation techniques. (State clearly any assumptions you make.)

(ii) examines the issues to be addressed in deciding whether to bid for Tefor at this juncture.

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale