3. Institutional Background. True or false? If false, correct the statement. (LOI) a. A corporation cannot pay

Question:

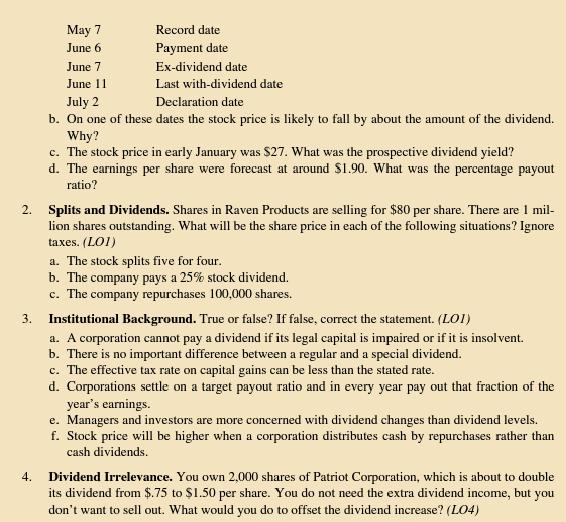

3. Institutional Background. True or false? If false, correct the statement. (LOI)

a. A corporation cannot pay a dividend if its legal capital is impaired or if it is insolvent.

b. There is no important difference between a regular and a special dividend.

c. The effective tax rate on capital gains can be less than the stated rate.

d. Corporations settle on a target payout ratio and in every year pay out that fraction of the year's earnings.

e. Managers and investors are more concerned with dividend changes than dividend levels.

f. Stock price will be higher when a corporation distributes cash by repurchases rather than cash dividends. Dividend Irrelevance. You own 2,000 shares of Patriot Corporation, which is about to double its dividend from $.75 to $1.50 per share. You do not need the extra dividend income, but you don't want to sell out. What would you do to offset the dividend increase? (LO4)

June 6 May 7 Record date Payment date Ex-dividend date Last with-dividend date June 7 June 11 July 2 Declaration date

June 6 May 7 Record date Payment date Ex-dividend date Last with-dividend date June 7 June 11 July 2 Declaration date

b. On one of these dates the stock price is likely to fall by about the amount of the dividend. Why?

c. The stock price in early January was $27. What was the prospective dividend yield?

d. The earnings per share were forecast at around $1.90. What was the percentage payout ratio?

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9780073382302

6th Edition

Authors: Richard A Brealey, Stewart C Myers, Alan J Marcus