4 Burnsall plc is a listed company which manufactures and distributes leisurewear under the brand name Paraffin.

Question:

4 Burnsall plc is a listed company which manufactures and distributes leisurewear under the brand name Paraffin. It made sales of 10 million units world-wide at an average wholesale price of £10 per unit during its last financial year ending at 30 June 1995. In 1995–96, it is planning to introduce a new brand, Meths, which will be sold at a lower unit price to more price-sensitive market segments. Allowing for negative effects on existing sales of Paraffin, the introduction of the new brand is expected to raise total sales value by 20 per cent To support greater sales activity, it is expected that additional financing, both capital and working, will be required. Burnsall expects to make capital expenditures of £20 million in 1995–96, partly to replace worn-out equipment but largely to support sales expansion. You may assume that, except for taxation, all current assets and current liabilities will vary directly in line with sales.

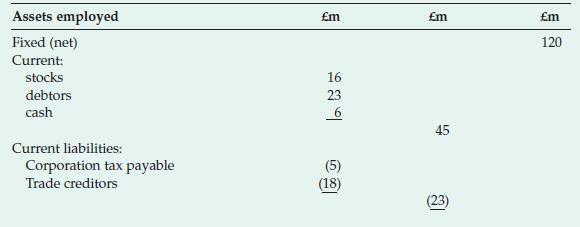

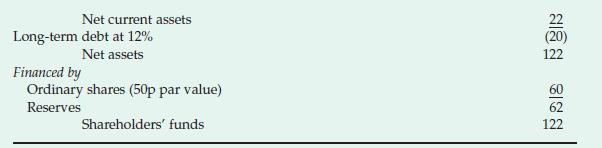

Burnsall’s summarised Balance Sheet for the financial year ending 30 June 1995 shows the following:

Burnsall’s profit before interest and tax in 1994–95 was 16 per cent of sales, after deducting depreciation of million. The depreciation charge for 1995–96 is expected to rise to £9 million. Corporation tax is levied at 33 per cent, paid with a one-year delay. Burnsall has an established distribution policy of raising dividends by 10 per cent p.a. In 1994–95, it paid dividends of £5 million net.

You have been approached to advise on the extra financing required to support the sales expansion.

Company policy is to avoid cash balances falling below 6 per cent of sales.

Required

(a) By projecting its financial statements, calculate how much additional external finance Burnsall must raise.

Notes:

1 It is not necessary to present your projection in FRS 1 format.

2 You may assume that all depreciation provisions qualify for tax relief.

(b) Offer advice as to the appropriate method of financing for Burnsall’s sales expansion.

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale