5 Galahad plc, a quoted manufacturer of textiles, has followed a policy in recent years of paying...

Question:

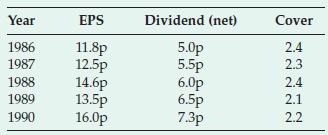

5 Galahad plc, a quoted manufacturer of textiles, has followed a policy in recent years of paying out a steadily increasing dividend per share as shown below:

Galahad has only just made the 1990 dividend payment, so the shares are quoted ex-dividend. The main board, which is responsible for strategic planning decisions, is considering a major change in strategy whereby greater financing will be provided by internal funds, involving a cut in the 1991 dividend to 5p (net) per share. The investment projects thus funded will increase the growth rate of Galahad’s earnings and dividends to 14 per cent. Some operating managers, however, feel that the new growth rate is unlikely to exceed 12 per cent. Galahad’s shareholders seek an overall return of 16 per cent.

Required

(a) Calculate the market price per share for Galahad, prior to the change in policy, using the Dividend Growth Model.

(b) Assess the likely impact on Galahad’s share price of the proposed policy change.

(c) Determine the break-even growth rate.

(d) Discuss the possible reaction of Galahad’s shareholders and of the capital market in general to this proposed dividend cut in the light of Galahad’s past dividend policy.

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale