5 Haverah plc is a manufacturer and distributor of denim garments. It employs a highly aggressive working

Question:

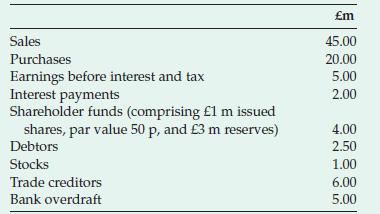

5 Haverah plc is a manufacturer and distributor of denim garments. It employs a highly aggressive working capital policy, and uses no long-term borrowing. Highlights from its most recent accounts appear below:

Killinghall is a supplier of cloth to Haverah and accounts for 40 per cent of its purchases. It is most anxious about Haverah’s policy of taking extended trade credit, so it offers Haverah the opportunity to pay for supplies within 25 days in return for a discount on the invoiced value of 4 per cent.

Haverah is able to borrow on overdraft from its bank at 10 per cent. Tax on corporate profit is paid at 30 per cent.

Required If Haverah made this arrangement with its supplier, what would be the effect on its working capital cycle and key accounting measures such as interest cover, profit after tax, earnings per share, return on equity and gearing?

Should it accept the offer?

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale