5 The directors of Fama Industries plc are currently considering the acquisition of Beaver plc as part

Question:

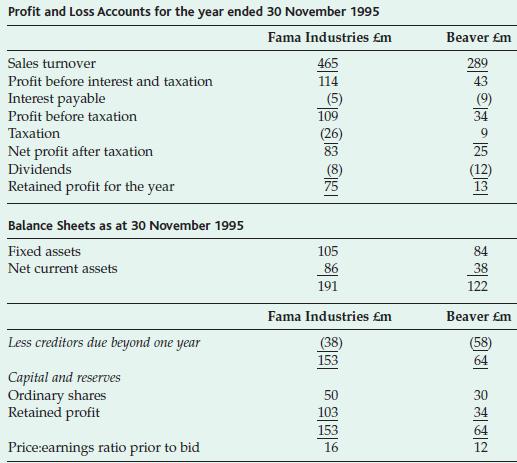

5 The directors of Fama Industries plc are currently considering the acquisition of Beaver plc as part of its expansion programme. Fama Industries plc has interests in machine tools and light engineering while Beaver plc is involved in magazine publishing. The following financial data concerning each company is available:

The ordinary share capital of Fama Industries plc consists of 50p shares and the share capital of Beaver plc consists of £1 shares. The directors of Fama Industries plc have made an offer of four shares for every five shares held in Beaver plc.

The directors of Fama Industries plc believe that combining the two businesses will lead to after-tax savings in overheads of £4 million per year.

Required

(a) Calculate:

(i) the total value of the proposed bid (ii) the earnings per share for Fama Industries plc following the successful takeover of Beaver plc (iii) the share price of Fama Industries plc following the takeover, assuming that the price:earning ratio is maintained and the savings are achieved.

(b) Comment on the value of the bid from the viewpoint of shareholders of both Fama Industries plc and Beaver plc.

(c) Identify, and briefly discuss, two reasons why the managers of a company may wish to take over another company. The reasons identified should not be related to the objective of maximising shareholder wealth.

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale