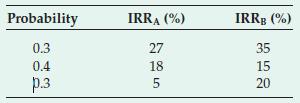

5 The management of Gawain plc is evaluating two projects whose returns depend on the future state...

Question:

5 The management of Gawain plc is evaluating two projects whose returns depend on the future state of the economy as shown below:

The project (or projects) accepted would double the size of Gawain.

Required

(a) Explain how a portfolio should be constructed to produce an expected return of 20 per cent.

(b) Calculate the correlation between projects A and B, and assess the degree of risk of the portfolio in (a).

(c) Gawain’s existing activities have a standard deviation of 10 per cent. How does the addition of the portfolio analysed in

(a) and

(b) affect risk?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale

Question Posted: