6 Laceby manufactures agricultural equipment and is currently all-equity financed. In previous years, it has paid out

Question:

6 Laceby manufactures agricultural equipment and is currently all-equity financed. In previous years, it has paid out a steady 50 per cent of available earnings as dividend and used retentions to finance investment in new projects, which have returned 16 per cent on average.

Its Beta is 0.83, and the return on the market portfolio is expected to be 17 per cent in the future, offering a risk premium of 6 per cent.

Laceby has just made earnings of £8 million before tax and the dividend will be paid in a few weeks’ time.

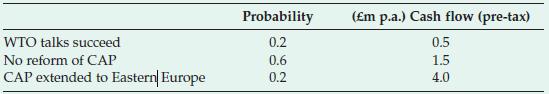

Some managers argue in favour of retaining an extra £2 million this year in order to finance the development of a new Common Agricultural Policy (CAP) surplus crop disposal machine. This may offer the following returns under the listed possible scenarios:

The project may be assumed to have an infinite life, and to attract an EU agricultural efficiency grant of £1 million. Corporation Tax is paid at 33 per cent (assume no tax delay).

Required

(a) What is the NPV of the proposed project?

(b) Value the equity of Laceby:

(i) before undertaking the project, (ii) after announcing the acceptance of the project.

(c) Assuming you have found an increase in value in (b)(ii), explain what conditions would be required to support such a conclusion.

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale