6 Megacorp plc, an all-equity financed multinational, is contemplating expansion into an overseas market. It is considering

Question:

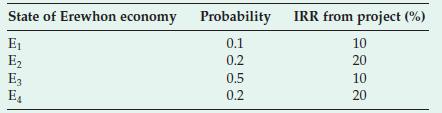

6 Megacorp plc, an all-equity financed multinational, is contemplating expansion into an overseas market. It is considering whether to invest directly in the country concerned by building a greenfield site factory. The expected payoff from the project would depend on the future state of the economy of Erewhon, the host country, as shown below:

Megacorp’s existing activities are expected to generate an overall return of 30 per cent with a standard deviation of 14 per cent. The correlation coefficient of Megacorp’s returns with that of the new project is Megacorp’s returns have a correlation coefficient of 0.80 with the return on the market portfolio, and the new project has a correlation coefficient of with the UK market portfolio.

■ The Beta coefficient for Megacorp is 1.20.

■ The risk-free rate is 12 per cent.

■ The risk premium on the UK market portfolio is 15 per cent.

■ Assume Megacorp’s shares are correctly priced by the market.

Required

(a) Determine the expected rate of return and standard deviation of the return from the new project.

(b) If the new project requires capital funding equal to 25 per cent of the value of the existing assets of Megacorp, determine the risk–return characteristics of Megacorp after the investment.

(c) What effect will the adoption of the project have on the Beta of Megacorp?

Ignore all taxes.

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale