8 You are the chief accountant of Deighton plc, which manufactures a wide range of building and...

Question:

8 You are the chief accountant of Deighton plc, which manufactures a wide range of building and plumbing fittings.

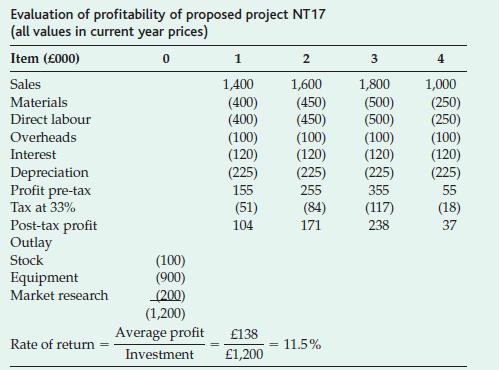

It has recently taken over a smaller unquoted competitor, Linton Ltd. Deighton is currently checking through various documents at Linton’s head office, including a number of investment appraisals. One of these, a recently rejected application involving an outlay on equipment of £900,000, is reproduced below. It was rejected because it failed to offer Linton’s target return on investment of 25 per cent (average profit-toinitial investment outlay). Closer inspection reveals several errors in the appraisal.

You discover the following further details:

1 Linton’s policy was to finance both working capital and fixed investment by a bank overdraft. A12 per cent interest rate applied at the time of the evaluation.

2 A 25 per cent writing-down allowance (WDA) on a reducing balance basis is offered for new investment.

Linton’s profits are sufficient to utilise fully this allowance throughout the project.

3 Corporation Tax is paid a year in arrears.

4 Of the overhead charge, about half reflects absorption of existing overhead costs.

5 The market research was actually undertaken to investigate two proposals, the other project also having been rejected. The total bill for all this research has already been paid.

6 Deighton itself requires a nominal return on new projects of 20 per cent after taxes, is currently ungeared and has no plans to use any debt finance in the future.

Required Write a report to the finance director in which you:

(a) Identify the mistakes made in Linton’s evaluation.

(b) Restate the investment appraisal in terms of the post-tax net present value to Deighton, recommending whether the project should be undertaken or not.

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale