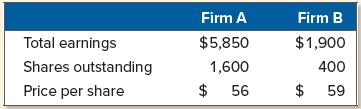

Consider the following premerger information about Firm A and Firm B: Assume that Firm A acquires Firm

Question:

Consider the following premerger information about Firm A and Firm B:

Assume that Firm A acquires Firm B via an exchange of stock at a price of $61 for each share of B’s stock. Both Firm A and Firm B have no debt outstanding.

a. What will the earnings per share (EPS) of Firm A be after the merger?

b. What will Firm A’s price per share be after the merger if the market incorrectly analyzes this reported earnings growth (that is, the price-earnings ratio does not change)?

c. What will the price-earnings ratio of the postmerger firm be if the market correctly analyzes the transaction?

d. If there are no synergy gains, what will the share price of Firm A be after the merger? What will the price-earnings ratio be? What does your answer for the share price tell you about the amount Firm A bid for Firm B? Was it too high? Too low? Explain.

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781265553609

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan