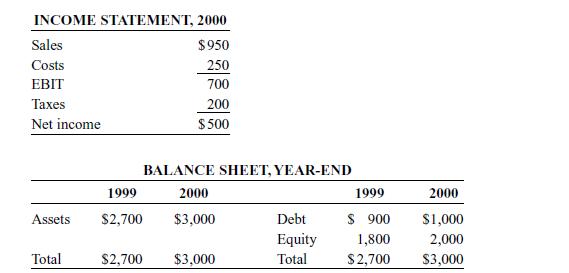

Eagle Sports Supply has the following financial statements. Assume that Eagles assets are proportional to its sales.

Question:

Eagle Sports Supply has the following financial statements. Assume that Eagle’s assets are proportional to its sales.

a. Find Eagle’s required external funds if it maintains a dividend payout ratio of 60 percent and plans a growth rate of 15 percent in 2001.

b. If Eagle chooses not to issue new shares of stock, what variable must be the balancing item? What will its value be?

c. Now suppose that the firm plans instead to increase long-term debt only to $1,100 and does not wish to issue any new shares of stock. Why must the dividend payment now be the balancing item? What will its value be?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: