For some projects, it may be advantageous to terminate the project early. For example, if a project

Question:

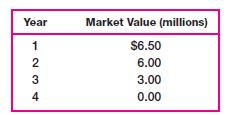

For some projects, it may be advantageous to terminate the project early. For example, if a project is losing money, you might be able to reduce your losses by scrapping out the assets and terminating the project, rather than continuing to lose money all the way through to the project’s completion. Consider the following project of Hand Clapper, Inc. The company is considering a four-year project to manufacture clap-command garage door openers. This project requires an initial investment of $8 million that will be depreciated straight-line to zero over the project’s life. An initial investment in net working capital of $2 million is required to support spare parts inventory; this cost is fully recoverable whenever the project ends. The company believes it can generate $7 million in pretax revenues with $3 million in total pretax operating costs. The tax rate is 38 percent and the discount rate is 16 percent. The market value of the equipment over the life of the project is as follows:

a. Assuming Hand Clapper operates this project for four years, what is the NPV?

b. Now compute the project NPV assuming the project is abandoned after only one year, after two years, and after three years. What economic life for this project maximizes its value to the firm? What does this problem tell you about not considering abandonment possibilities when evaluating projects?

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9780072553079

6th Edition

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan