Just Dew It Corporation reports the following balance sheet information for 2001 and 2002. Based on the

Question:

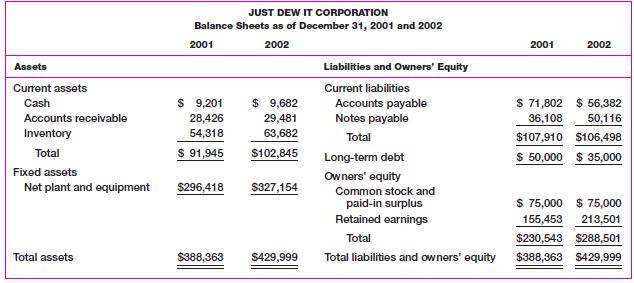

Just Dew It Corporation reports the following balance sheet information for 2001 and 2002.

Based on the balance sheets given for Just Dew It, calculate the following financial ratios for each year:

a. Current ratio

b. Quick ratio

c. Cash ratio

d. NWC to total assets ratio

e. Debt-equity ratio and equity multiplier

f. Total debt ratio and long-term debt ratio

Transcribed Image Text:

Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets JUST DEW IT CORPORATION Balance Sheets as of December 31, 2001 and 2002 2001 2002 $ 9,201 28,426 54,318 $ 91,945 $296,418 $388,363 $ 9,682 29,481 63,682 $102,845 $327,154 $429,999 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in surplus Retained earnings Total Total liabilities and owners' equity 2001 $ 71,802 36,108 $107,910 $ 50,000 2002 $ 56,382 50,116 $106,498 $35,000 $ 75,000 $75,000 155,453 213,501 $230,543 $288,501 $388,363 $429,999

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Current Ratio Current AssetsCurrent Liabilities 2001 2002 Current Assets 91945 102845 Current Liabil...View the full answer

Answered By

Saikumar Ramagiri

Financial accounting:- Journal and ledgers, preparation of trail balance and adjusted trail balance Preparation of income statement, retained earning statement and balance sheet Banks reconciliation statements Financial statement analysis Cash flow statement analysis (both direct and indirect methods) All methods of Depreciations Management Accounting:- Ratios Budgeting control Cash budget and production budget Working capital management Receivable management Costing:- Standard and variance costing Marginal costing and decision making Cost-volume-profit analysis Inventory management (LIFO, FIFO) Preparation and estimation of cost sheet Portfolio management:- Calculation of portfolio standard deviation or risk Calculation of portfolio expected returns CAPM, Beta Financial management:- Time value of money Capital budgeting Cost of capital Leverage analysis and capital structure policies Dividend policy Bond value calculations like YTM, current yield etc International finance:- Derivatives Futures and options Swaps and forwards Business problems Finance problems Education (mention all your degrees, year awarded, Institute/University, field(s) of major): Education Qualification Board/Institution/ University Month/Year of Passing % Secured OPTIONALS/ Major ICWAI(inter) ICWAI inter Pursuing Pursuing - M.com(Finance) Osmania University June 2007 65 Finance & Taxation M B A (Finance) Osmania University Dec 2004 66 Finance & Marketing. B.Com Osmania University June 2002 72 Income Tax, Cost & Mgt, Accountancy, Auditing. Intermediate (XII) Board of Intermediate May 1999 58 Mathematics, Accountancy, Economics. S S C (X) S S C Board. May 1997 74 Mathematics, Social Studies, Science. Tutoring experience: • 10 year experience in online trouble shooting problems related to finance/accountancy. • Since 6 Years working with solution inn as a tutor, I have solved thousands of questions, quick and accuracy Skills (optional): Technical Exposure: MS Office, SQL, Tally, Wings, Focus, Programming with C Financial : Portfolio/Financial Management, Ratio Analysis, Capital Budgeting Stock Valuation & Dividend Policy, Bond Valuations Individual Skills : Proactive Nature, Self Motivative, Clear thought process, Quick problem solving skills, flexible to complex situations. Achievements : 1. I have received an Award certificate from Local Area MLA for the cause of getting 100% marks in Accountancy during my Graduation. 2. I have received a GOLD MEDAL/Scholarship from Home Minister in my MBA for being the “Top Rank student “ of management institute. 3. I received numerous complements and extra pay from various students for trouble shooting their online problems. Other interests/Hobbies (optional): ? Web Surfing ? Sports ? Watching Comics, News channels ? Miniature Collection ? Exploring hidden facts ? Solving riddles and puzzles

4.80+

391+ Reviews

552+ Question Solved

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780072553079

6th Edition

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan

Question Posted:

Students also viewed these Business questions

-

You own a promotions company (MC) that has been a vendor to the American Minor League Widgetball (AMLW) team the Scorpions. You have been dealing with the Chief Marketing Officer (CMO) for all...

-

Just Dew It Corporation reports the following balance sheet information for 2001 and 2002. Prepare the 2001 and 2002 common-size balance sheets for Just Dew It. Assets Current assets Cash Accounts...

-

Just Dew It Corporation reports the following balance sheet information for 2001 and 2002. Prepare the 2002 combined common-size, commonbase year balance sheet for Just Dew It. Assets Current assets...

-

Question 2A) Explain the differences between right issues and bonusissues. Your answer should include the advantages and disadvantagesof both right issues and bonus issues. [ 8marks}b) Explain pos 0...

-

Rockaway Water Company reported the following items on its statement of shareholders equity for the year ended December 31, 2010: Requirements 1. Determine the December 31, 2010, balances in Rockaway...

-

What are regularities in the environment? Describe physical regularities and semantic regularities. Be sure you understand the following concepts and experiments: oblique effect; light-from-above...

-

15. Bob invests $10,000 cash for a 25 percent interest in the capital and earnings of the BOP Partnership. Explain how this investment could give rise to (a) recording goodwill, (b) the write-down of...

-

1. Is this form of analysis appropriate? 2. Interpret the computer output and critique the analysis. 3. Explore the GLM (General Linear Model) procedure in SAS or SPSS by testing a model using...

-

On February 1, 2021, Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,250,000. During 2021, costs of $2,100,000 were incurred with...

-

Y3K, Inc., has sales of $2,300, total assets of $1,020, and a debt-equity ratio of 1.00. If its return on equity is 18 percent, what is its net income?

-

Just Dew It Corporation reports the following balance sheet information for 2001 and 2002. For each account on this companys balance sheet, show the change in the account during 2002 and note whether...

-

The parties' marriage was dissolved on August 27, 2010. The parties had an agreement which the court incorporated into its judgment of dissolution. On February 11, 2015, Defendant filed a Motion to...

-

The following information about the payroll for the week ended December 30 was obtained from the records of Saine Co.: Salaries: Sales salaries Deductions: $180,000 Income tax withheld $65,296...

-

You have just been hired as the chief executive officer (CEO) in a medium-sized organization. The organization is not suffering financially, but neither is it doing as well as it could do. This is...

-

The following is the selling price and cost information about three joint products: X Y Z Anticipated production 1 2 , 0 0 0 lbs . 8 , 0 0 0 lbs . 7 , 0 0 0 lbs . Selling price / lb . at split - off...

-

calculate the maximum bending compressive stress of the following section under NEGATIVE bending moment of 216KN.m. 216mm 416mm 316mm 115mm

-

Need assistance with the following forms: 1040 Schedule 1 Schedule 2 Schedule C Schedule SE Form 4562 Form 8995 Appendix B, CP B-3 Christian Everland (SS number 412-34-5670) is single and resides at...

-

Using only the sunspot numbers, identify the highest number and convert it to a z score. In the context of these sample data, is that highest value "significantly high"? Why or why not? Listed below...

-

Problem 3.5 (4 points). We will prove, in steps, that rank (L) = rank(LT) for any LE Rnxm (a) Prove that rank (L) = rank (LTL). (Hint: use Problem 3.4.) (b) Use part (a) to deduce that that rank(L) =...

-

Calculating Present Values For each of the following, compute the present value: Present Value Future Value $ 15,451 Interest Rate Years 6. 4% 11 51,557 886,073 23 20 18 550,164 13

-

Calculating Interest Rates Solve for the unknown interest rate in each of thefollowing: Interest Rate Future Value Present Value $ 240 360 39.000 Years 2 10 15 307 896 174,384 483,500 38,261 30

-

Calculating the Number of Periods Solve for the unknown number of years in each of the following: Interest Rate 8% Future Value $ 1,284 Present Value $ 560 Years 4.341 364,518 A10 21 18 400 21.500...

-

C0 = 10.648148 b) ( 4 Marks ) As of now, Given the above conditions on the option, what is the intrinsic value of the call option? What is the time value of the call option?

-

interest revenue 19,500 retained earning,end 5,000 selling expenses 145,00 prepaid insurance 20,000 loss and disposal of a business (discountied),net 28,000 income from operation 140,000 unearned...

-

cost that do not extend the acid capacity or it's useful life, but merely maintained the assd, or restore it to working order are recorded as losses True or False

Study smarter with the SolutionInn App