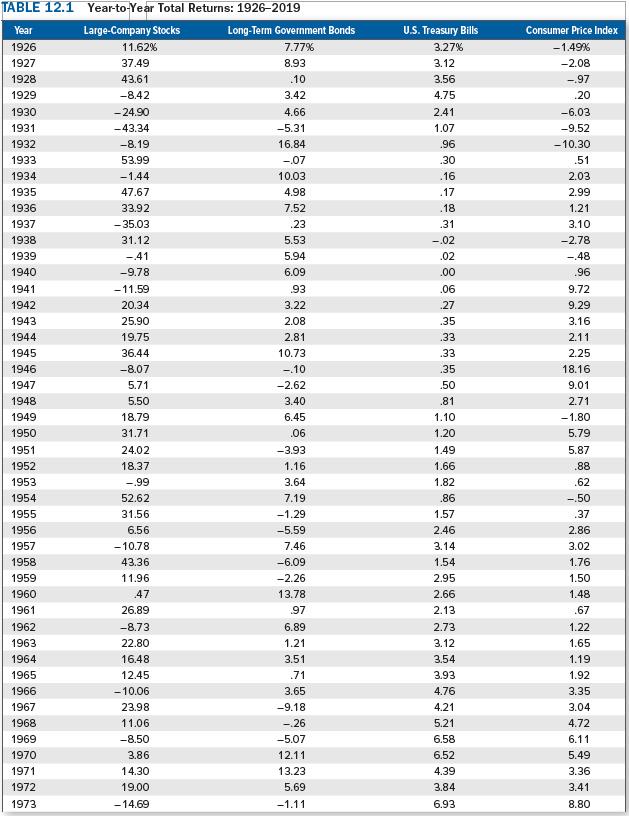

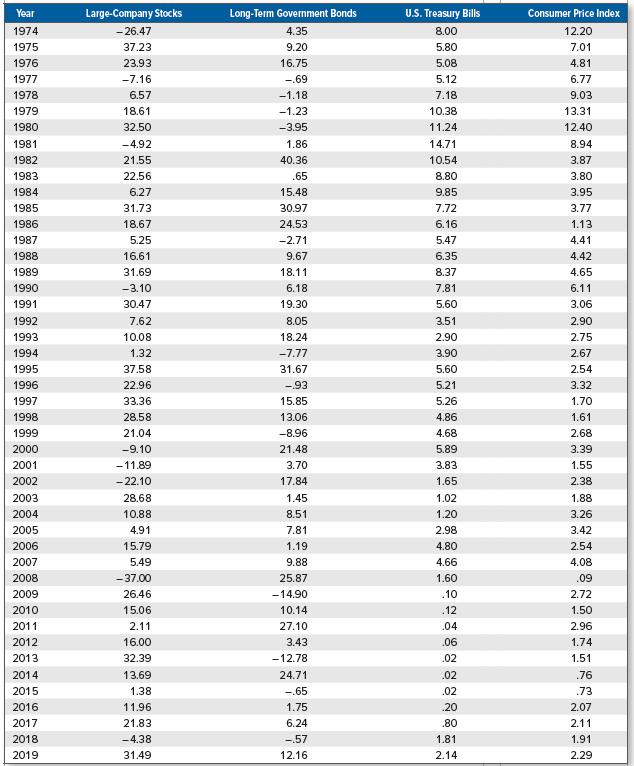

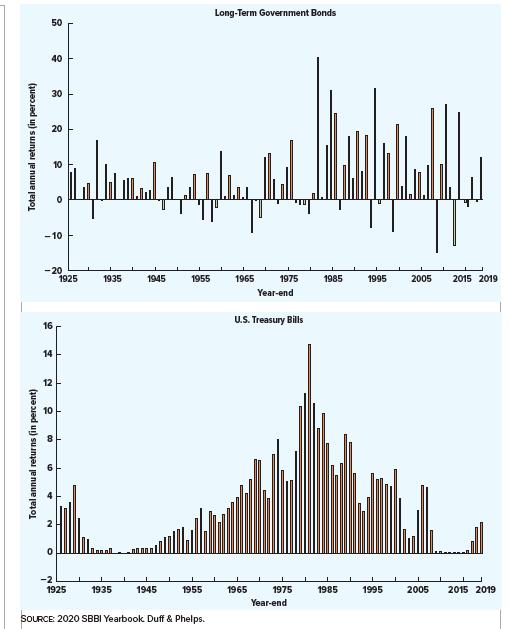

Look at Table 12.1 and Figure 12.7 in the text. When were T-bill rates at their highest

Question:

Look at Table 12.1 and Figure 12.7 in the text. When were T-bill rates at their highest over the period from 1926 through 2019? Why do you think they were so high during this period? What relationship underlies your answer?

Table 12.1

Figure 12.7

TABLE 12.1 Year-to-Year Total Returns: 1926-2019 Year Large-Company Stocks Long-Term Government Bonds U.S. Treasury Bills Consumer Price Index 1926 11.62% 7.77% 3.27% -1.49% 1927 37.49 8.93 3.12 -2.08 1928 43.61 .10 3.56 -.97 1929 -8.42 3.42 4.75 .20 1930 -24.90 4.66 2.41 -6.03 1931 -43.34 -5.31 1.07 -9.52 1932 -8.19 16.84 .96 -10.30 1933 53.99 -07 .30 .51 1934 -1.44 10.03 .16 2.03 1935 47.67 4.98 .17 2.99 1936 33.92 7.52 .18 1.21 1937 -35.03 .23 .31 3.10 1938 31.12 5.53 -.02 -2.78 1939 -41 5.94 .02 -48 1940 -9.78 6.09 .00 .96 1941 -11.59 .93 .06 9.72 1942 20.34 3.22 .27 9.29 1943 25.90 2.08 .35 3.16 1944 19.75 2.81 .33 2.11 1945 36.44 10.73 .33 2.25 1946 -8.07 -.10 .35 18.16 1947 5.71 -2.62 .50 9.01 1948 5.50 3.40 .81 2.71 1949 18.79 6.45 1.10 -1.80 1950 31.71 .06 1.20 5.79 1951 24.02 -3.93 1.49 5.87 1952 18.37 1.16 1.66 .88 1953 -.99 3.64 1.82 .62 1954 52.62 7.19 .86 -.50 1955 31.56 -1.29 1.57 .37 1956 6.56 -5.59 2.46 2.86 1957 - 10.78 7.46 3.14 3.02 1958 43.36 -6.09 1.54 1.76 1959 11.96 -2.26 2.95 1.50 1960 47 13.78 2.66 1.48 1961 26.89 .97 2.13 .67 1962 -8.73 6.89 2.73 1.22 1963 22.80 1.21 3.12 1.65 1964 16.48 3.51 3.54 1.19 1965 12.45 .71 3.93 1.92 1966 -10.06 3.65 4.76 3.35 1967 23.98 -9.18 4.21 3.04 1968 11.06 -.26 5.21 4.72 1969 -8.50 -5.07 6.58 6.11 1970 3.86 12.11 6.52 5.49 1971 14.30 13.23 4.39 3.36 1972 19.00 5.69 3.84 3.41 1973 -14.69 -1.11 6.93 8.80

Step by Step Answer:

As we can see from the table 1...View the full answer

Fundamentals Of Corporate Finance

ISBN: 9781265553609

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Business questions

-

Why do you think so many employers search for information about job applicants online using Google, Facebook, Twitter, and other online tools? Do you think these kinds of searches are ethical or...

-

Why do you think so many pieces of important legislation related to financial markets and institutions were passed during the Great Depression?

-

Why do you think workplace stress seems to be skyrocketing? Do you think it is a trend that will continue? Explain the reasons for your answer. Do you think it is the responsibility of managers and...

-

Why are all three levels of Transfer Meaning Making Acquisition important? What would happen if we left one out of our unit design?

-

A 45.0-mL sample of 0.0015 MBaCl2 was added to a beaker containing 75.0 mL of 0.0025 M KF. Will a precipitate form?

-

Dorina Company makes cases of canned dog food in batches of 1,000 cases and sells each case for $15. The plant capacity is 50,000 cases; the company currently makes 40,000 cases. DoggieMart has...

-

Choose your own company and repeat the analysis from Problem 1. You can get the data from MoneyCentral Investor at http:// moneycentral.msn.com/investor/home.asp. To retrieve the data for your...

-

Suppose the production possibility frontier for cheeseburgers (C) and milkshakes (M) is given by C + 2M = 600 a. Graph this function. b. Assuming that people prefer to eat two cheeseburgers with...

-

Hana Culture Comoros ac coffee beans. The post offee beans to the Ring Orient. From the Ring Department coffee bean than were to the rain Department. The following is a part work in account of the...

-

True or False: Strategic planning sets the long-term direction to be taken by the organization and each of its component parts. It should also guide organizational efforts and focus resources toward...

-

Youve observed the following returns on Pine Computers stock over the past five years: 8 percent, 12 percent, 14 percent, 21 percent, and 16 percent. a. What was the arithmetic average return on the...

-

Given that Zoom was up by about 250 percent for in the first half of 2020, why didnt all investors hold this stock?

-

Refer to the data in Problem. Estimate the cash from operations expected in year 2. In Problem, Cameron Parts has the following data from year 1 operations, which are to be used for developing year 2...

-

HW: Forces Begin Date: 9/24/2023 12:01:00 AM -- Due Date: 11/9/2023 11:59:00 PM End Date: 12/15/2023 11:59:00 PM (17%) Problem 4: A flea (of mass 6 10-7 kg) jumps by exerting a force of 1.45 10-5 N...

-

Zephyr Minerals completed the following transactions involving machinery. Machine No. 1550 was purchased for cash on April 1, 2020, at an installed cost of $87,000. Its useful life was estimated to...

-

Stock Valuation at Ragan Engines Larissa has been talking with the company's directors about the future of East Coast Yachts. To this point, the company has used outside suppliers for various key...

-

On January 1, 20X1, Elberta Company issued $50,000 of 4% convertible bonds, in total, into 5,000 shares of Elberta's common stock. No bonds were converted during 20X1. Throughout 20X1 Elberta had...

-

At Vision Club Company, office workers are employed for a 40-hour workweek and are quoted either a monthly or an annual salary (as indicated). Given on the form below are the current annual and...

-

Comco Tool Corp. records depreciation annually at the end of the year. Its policy is to take a full year?s depreciation on all assets that are used throughout the year and depreciation for half a...

-

Let X be a random variable taking on values a1, a2, . . . , pr with probabilities p1, p2, . . . , pr and with E(X) = μ. Define the spread of X as follows: This, like the standard deviation, is a...

-

Chevelle, Inc., is obligated to pay its creditors $8,400 during the year. a. What is the value of the shareholders' equity if assets equal $9,300? b. What if assets equal $6,900?

-

Corporation Growth has $76,500 in taxable income, and Corporation Income has $7,650,000 in taxable income. a. What is the tax bill for each firm? b. Suppose both firms have identified a new project...

-

During the year, Belyk Paving Co. had sales of $2,350,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,295,000, $530,000, and $420,000, respectively. In...

-

THIS IS ONE QUESTION WITH TWO PARTS. PLEASE ANSWER COMPLETELY AND SHOW ALL WORK. (NO EXCEL) Information for Question 1: State Probability Retum on A Return on B Return on C Retum on Portfolio X Boom...

-

Direct materials (5.0 Ibs. @ $5.00 per Ib.) Direct labor (2.0 hrs. @ $13.00 per hr.) Overhead (2.0 hrs. @ $18.50 per hr.) Total standard cost $25.00 26.00 37.00 $88.00 The predetermined overhead rate...

-

Problem 1-28 (Algo) (LO 1-4, 1-5, 1-6b 1-7) Harper, Inc., acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2020, for $316,100 in cash. The book value of Kinman's...

Study smarter with the SolutionInn App