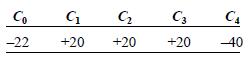

Multiple IRR. Consider the following cash flows: a. Confirm that one internal rate of return on this

Question:

Multiple IRR. Consider the following cash flows:

a. Confirm that one internal rate of return on this project is (a shade above) 7 percent, and that the other is (a shade below) 34 percent.

b. Is the project attractive if the discount rate is 5 percent?

c. What if it is 20 percent? 40 percent?

d. Why is the project attractive at midrange discount rates but not at very high or very low rates?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Study Guide To Accompany Fundamentals Of Corporate Finance

ISBN: 9780073012421

5th Edition

Authors: Richard Brealey, Stewart Myers, Alan Marcus

Question Posted: