Refer to Table 23.2 in the text to answer this question. Suppose you purchase the November 2001

Question:

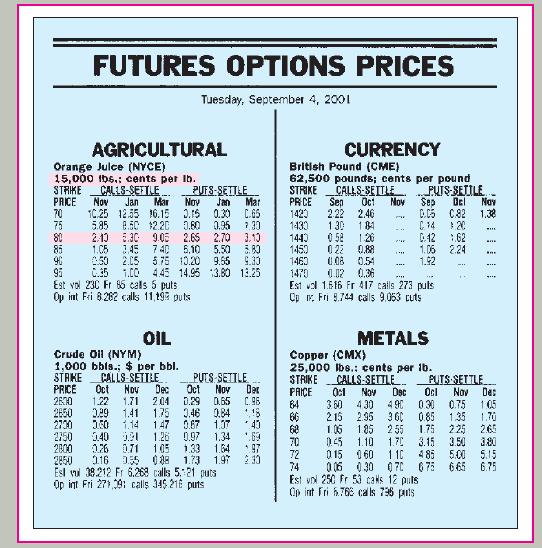

Refer to Table 23.2 in the text to answer this question. Suppose you purchase the November 2001 call option on crude oil futures with a strike price of $27.50. How much does your option cost per barrel of oil? What is the total cost? Suppose the price of oil futures is $26.25 per barrel at expiration of the option contract. What is your net profit or loss from this position? What if oil futures prices are $29 per barrel at expiration?

TABLE 23.2

Transcribed Image Text:

FUTURES OPTIONS PRICES Tuesday, September 4, 2001 AGRICULTURAL Orange Julce (NYCE) 15,000 lbs.: cents per Ib. STRIKE PRICE 70 75 Nov CALLS-SEFTLE Jan Mar Mar Nov 10.25 12.55 16.15 3.15 0.30 0.65 5.85 8.50 12.20 0.60 0.95 2.30 2.10 5.30 9.05 2.65 2.70 3.10 1.05 1,45 740 5.10 5.50 5.80 050 2.05 5.75 10.20 9.55 9.30 C.35 1.00 4.45 14.95 Est vol 230 Fr 86 calls 5 puts Op int Fri 8.282 calls 11,19 puts 3.80 13.25 PUFS-SETTLE Jan OIL Crude Oll (NYM) 1,000 bbls.; $ per bbl. STAKE CALLS-SETTLE Oct Nov PRICE Dec 1.22 1.71 204 PUTS SETTLE Nov Dec Oct 0.29 0.65 C.96 3.46 0.84 1.18 0.67 1.07 0.97 1.34 1.33 1.54 26:00 2650 0.29 1.41 1.75 2700 3.50 1.14 147 2750 5.40 9.9 2800 0.26 0.71 105 2850 0.16 0.55 088 1.73 1.97 1.26 Esl v 38.212 Fr 6.268 calls 5:21 puts Op int Fri 271 291 calls 345 216 puts 1424 *40 CORRES 1.69 97 British Pound (CME) 62,500 pounds; cents per pound CURRENCY STRIKE PRICE 1420 1430 130 181 1440 0.52 1:26 1450 0.22 0.88 1460 0.08 0.54 1470 0.02 0.36 *** Est vol 1616 Fr 417 calls 273 puls Op . Fri 9.744 calls 9.053 cuts 388R22. 68 CALLS-SETTLE 70 72 Sep 2.22 2.46 Oct Nov www www PUTS-SETTLE.. Sep Del L Copper (CMX) 25,000 lbs.: cents per lb. STRIKE PRICE 64 66 Nov 0.05 0.82 1.38 C14 20 0.42 1.62 1.06 2.24 1.92 METALS TILL CALLS-SETTLE PUTS SETTLE Oct Nov Dac Oct Nov Dec 3.60 4.30 490 0.30 0.75 215 2.95 360 0.85 1.35 1.70 1.06 1.85 255 1.75 2.25 2.65 0.45 1.10 1.70 3.15 3.50 0.15 060 110 485 5.00 5.15 74 006 0.30 070 675 6.65 6.75 Est vn 250 Fr 53 caks 12 puls Op int Fri 5.768 calls 736 puts an For ***

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

Cost of the November 2001 call option on crude oil futures with a strike price of 2750 per barrel Th...View the full answer

Answered By

Gilbert Chesire

I am a diligent writer who understands the writing conventions used in the industry and with the expertise to produce high quality papers at all times. I love to write plagiarism free work with which the grammar flows perfectly. I write both academics and articles with a lot of enthusiasm. I am always determined to put the interests of my customers before mine so as to build a cohesive environment where we can benefit from each other. I value all my clients and I pay them back by delivering the quality of work they yearn to get.

4.80+

14+ Reviews

49+ Question Solved

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9780072553079

6th Edition

Authors: Stephen A. Ross, Randolph Westerfield, Bradford D. Jordan

Question Posted:

Students also viewed these Business questions

-

Refer to Figure 24.11 in the text to answer this question. Suppose you purchase an August 2012 call option on crude oil futures with a strike price of 8500 cents per barrel. How much does your option...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Last Sale Net Bid Ask Open Int Puts Last Sale Net bid Ask Vol Open Int 16Aug 155.00(1619H155-E) 6.45 0.75 6.95 7.25 9 16Aug 155.00(1619T155-E) 1.18 (0.75) 1.17 1.25 61 4505 16Aug 166.00(1619H160-E)...

-

We often speak of how price rations goods. What are other rationing measures in clinics in which free care is provided?

-

a. Create data flow diagrams of the revenue and expenditure procedures. b. Create system flowcharts of the current revenue and expenditure procedures. c. Analyze the internal control and operational...

-

LO9 Gary and Gertrude are married on April 8, 2009. They use Gertrudes home as their residence. Gertrude purchased the home on November 14, 2007, for $60,000. On February 19, 2010, Gertrude is killed...

-

On examining the bank passbook of Oberoi Ltd., it is found that the balance shown on 31 March 1993, the close of the company's financial year, differs from the bank balance of *23,650 shown by the...

-

Background: A new ownership group has recently purchased ABC Liquors. You have been hired by the new management team to analyze their sales data for the past year and provide them with insights about...

-

Central Beverages is planning of introducing a nutritious beverage Super-sip which will come in three flavours mainly Orange, Mango and Banana. The management Accountant has provided the relevant...

-

You want to find the price of a future on light sweet crude oils. Go to the New York Mercantile Exchange at www.nymex.com and follow the Markets link, the Quotes link, then the Quotes, Charts, Settle...

-

Refer to Table 23.1 in the text to answer this question. Suppose today is September 4, 2001, and your firm is a piping manufacturer that needs 100,000 pounds of copper in March for the upcoming...

-

Develop the If/Then rules for an expert system that selects a term class schedule for a particular student. (Warning: This can require a large number of rules.) Assume you can use the system in your...

-

From the perspective of organizational structure, design, and control, what have gone wrong at PNB? What factors have contributed to its current state of disarray? What should be done next to help...

-

Your goal is to advise the President on domestic economic policy. Role You are the chair of the Council of Economic Advisors (CEA) Audience Your audience is the President of the United States....

-

omework quiz 2.1 #1 stem plot The miles per gallon rating for 30 cars are shown below (lowest to highest). 19, 19, 19, 20, 21, 21, 25, 25, 25, 26, 26, 28, 29, 31, 31, 32, 32, 33, 34, 35, 36, 37, 37,...

-

Your answers are saved automatically. Question Completion Status: QUESTION 1 13 points Save Answer Library A computer memory manufacturer specifies that its memory chip stores data incorrectly an...

-

Analyze the possible reasons for and responses to Chung's request for a private office. What factors might impact Leary's decision? Identify at least two challenges and dilemmas in managing...

-

Journalize, record, and post when appropriate the following transactions into the general journal (p. 2) for Cody's Clothing. All purchases discounts are 1/10, n/30. Assume the periodic inventory...

-

Experiment: Tossing four coins Event: Getting three heads Identify the sample space of the probability experiment and determine the number of outcomes in the event. Draw a tree diagram when...

-

Pullman Corp issued 10-year bonds four years ago with a coupon rate of 9.375 percent. At the time of issue, the bonds sold at par. Today bonds of similar risk and maturity must pay an annual coupon...

-

Marshall Company is issuing eight-year bonds with a coupon rate of 6.5 percent and semiannual coupon payments. If the current market rate for similar bonds is 8 percent, what will be the bond price?...

-

Rockne, Inc., has outstanding bonds that will mature in six years and pay an 8 percent coupon semiannually. If you paid $1,036.65 today and your required rate of return was 6.6 percent, did you pay...

-

Indicate whether the following managerial policy increases the risk of a death spiral:Use of low operating leverage for productionGroup of answer choicesTrueFalse

-

It is typically inappropriate to include the costs of excess capacity in product prices; instead, it should be written off directly to an expense account.Group of answer choicesTrueFalse

-

Firms can avoid the death spiral by excluding excess capacity from their activity bases. Group of answer choicesTrueFalse

Study smarter with the SolutionInn App