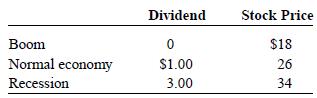

Scenario Analysis. The common stock of Escapist Films sells for $25 a share and offers the following

Question:

Scenario Analysis. The common stock of Escapist Films sells for $25 a share and offers the following payoffs next year:

Calculate the expected return and standard deviation of Escapist. All three scenarios are equally likely. Then calculate the expected return and standard deviation of a portfolio half invested in Escapist and half in Leaning Tower of Pita (from problem 14). Show that the portfolio standard deviation is lower than either stock’s. Explain why this happens.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Study Guide To Accompany Fundamentals Of Corporate Finance

ISBN: 9780073012421

5th Edition

Authors: Richard Brealey, Stewart Myers, Alan Marcus

Question Posted: