Sterling Wyatt, the president of Howlett Industries, has been exploring ways of improving the companys financial performance.

Question:

Sterling Wyatt, the president of Howlett Industries, has been exploring ways of improving the company’s financial performance. Howlett manufactures and sells office equipment to retailers. The company’s growth has been relatively slow in recent years, but with an expansion in the economy, it appears that sales may increase more rapidly in the future. Sterling has asked Evan Bradds, the company’s treasurer, to examine Howlett’s credit policy to see if a change can help increase profitability. The company currently has a policy of net 30. As with any credit sales, default rates are always of concern. Because of Howlett’s screening and collection process, the default rate on credit is currently only 1.6 percent. Evan has examined the company’s credit policy in relation to other vendors, and he has found three available options.

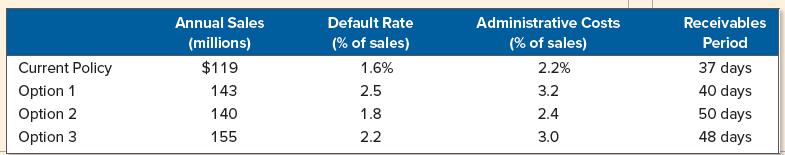

The first option is to relax the company’s decision on when to grant credit. The second option is to increase the credit period to net 45, and the third option is a combination of the relaxed credit policy and the extension of the credit period to net 45. On the positive side, each of the three policies under consideration would increase sales. The three policies have the drawbacks that default rates would increase, the administrative costs of managing the firm’s receivables would increase, and the receivables period would increase. The effect of the credit policy change would affect all four of these variables to different degrees. Evan has prepared the following table outlining the effect on each of these variables:

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781265553609

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan