Greg Schwartz is an automotive enthusiast. He has over 25 years experience working as a mechanic for

Question:

Greg Schwartz is an automotive enthusiast. He has over 25 years experience working as a mechanic for the dealership of a large car manufacturer in Oakville. Greg also gained experience doing minor body work and painting.

Recently, Greg decided to retire from the car dealership and pursue his interest of restoring classic American muscle cars. Accordingly, Greg started Antique Automotive Restoration (AAR). Greg leased an industrial building, and converted it into a repair and body shop. The building’s land has a small parking lot that is used to showcase the restored vehicles that are for sale.

Generally, Greg selects the classic muscle cars that AAR will restore and then places them for sale to the general public in the lot. Greg also posts his vehicles to various Internet sales sites, frequents car shows, and uses the classifieds of local newspapers to market his inventory. AAR also takes custom jobs, whereby an individual can request the car to be restored.

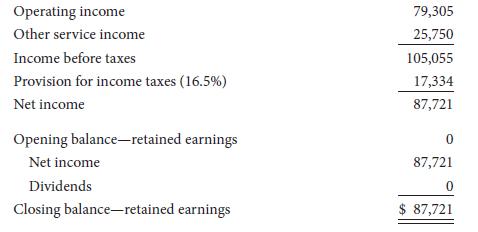

AAR has a December 31, 2017, year end, and just completed its first year of operations. Greg had a friend help him compile financial statements for the year end (draft financial statements can be found in Exhibit I). AAR’s bank requires the preparation of annual audited financial statements in accordance with IFRS (details of the loan agreement can be found in Exhibit II) and the auditors are scheduled to commence year-end work on January 18.

Realizing that AAR needs accounting assistance, Greg has hired you, CPA, as a consultant on December 24, 2017. Your first task is to review the draft financial statements and provide any recommendations to comply with IFRS. In addition, Greg required some assistance preparing a statement of cash flow. Greg has provided you with a file for review, which outlines all of the signifi cant transactions that have taken place during the year (Exhibit III).

Aside from the year-end statements, Greg would also like to know whether he will be able to pay any dividends in the current year. He has drawn a minimal salary, and is hoping to supplement his income by paying a $35,000 dividend with the current cash balance.

Finally, Greg has asked you to provide some advice regarding the additional controls or procedures that could be implemented to improve the day-to-day operations of the company.

Required Greg has asked you to prepare a report that discusses all of the material accounting issues (i.e., identify the issues, discuss the implications, off er alternative treatments, and provide a recommendation). Revised financial statements should be included in the report. The report should also address Greg’s other concerns. Provide journal entries, where appropriate.

EXHIBIT II – BANK LOAN AGREEMENT The Bank of Toronto has provided a $300,000 loan to help finance working capital and capital assets. Th e following are the terms and conditions of the loan. » Security: The bank secures its loan with a first claim against inventory and accounts receivable. » Repayment: The loan is to be repaid over a 10-year period, with blended monthly payments. » Interest rate: The rate of interest is 6%, effective annual rate (EAR). » Covenants: AAR must comply with the following covenants:

•

The current ratio must not be below 2:1.

•

The debt to equity ratio must not exceed 3:1. Debt is defined as both current and long-term liabilities.

A violation of either covenant will result in the loan becoming payable upon demand.

» Financial statements: Audited fi nancial statements are to be presented no later than 60 days aft er year end. Financial statements can be prepared with IFRS.

Step by Step Answer:

Canadian Financial Accounting Cases

ISBN: 9781119277927

2nd Canadian Edition

Authors: Camillo Lento, Jo Anne Ryan