Use the information in M5-10 to identify outstanding deposits that should be included in the May 31

Question:

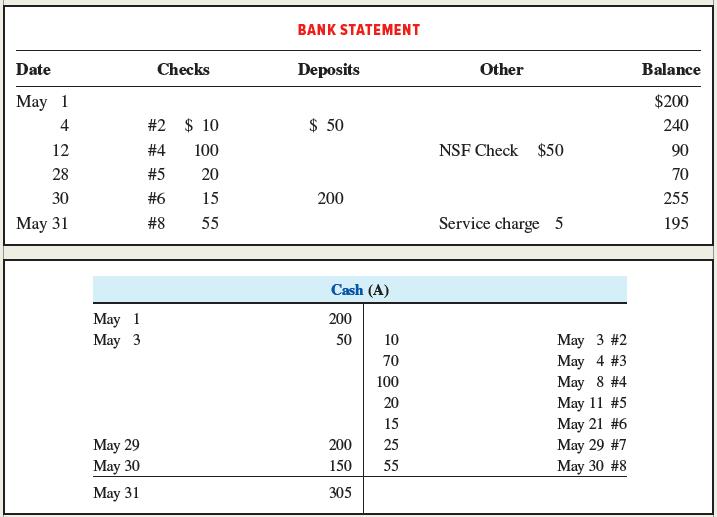

Use the information in M5-10 to identify outstanding deposits that should be included in the May 31 bank reconciliation.

Data From M5-10

Use the following bank statement and T-account to identify outstanding checks that should be included in the May 31 bank reconciliation.

Transcribed Image Text:

BANK STATEMENT Date Checks Deposits Other Balance May 1 $200 4 #2 $ 10 $ 50 240 12 #4 100 NSF Check $50 90 28 #5 20 70 30 #6 15 200 255 May 31 #8 55 Service charge 5 195 Cash (A) May 1 May 3 200 May 3 #2 May 4 #3 May 8 #4 May 11 #5 May 21 #6 May 29 #7 May 30 #8 50 10 70 100 20 15 May 29 May 30 200 25 150 55 May 31 305

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (9 reviews)

The May 31 bank r...View the full answer

Answered By

Marcus Solomon

I am committed to ensuring that my services always meet the clients' expectations.

4.60+

82+ Reviews

117+ Question Solved

Related Book For

Fundamentals Of Financial Accounting

ISBN: 9781265440169

7th Edition

Authors: Fred Phillips, Shana Clor Proell, Robert Libby, Patricia Libby

Question Posted:

Students also viewed these Business questions

-

Identify the costs that should be included in the cost of inventories purchased for resale according to the Australian Accounting Standards.

-

Use the information in Exercise C-10 (if completed, you can also use your solution to Exercise C-11) to prepare an October 31 balance sheet for Tech Talk.

-

Use the information in RE9-8. Calculate Uncle Butchs Hunting Supply Shops ending inventory using the retail inventory method under the average cost assumption. In RE9-8, Uncle Butchs Hunting Supply...

-

Show that for an integer n > 2, the period of the decimal expression for the rational number is at most n - 1. Find the first few values of n for which the period of - is equal ton- 1. Do you notice...

-

Show how the polytropic exponent n can be evaluated if you know the end state properties, (P1, V2) and (P2, V2).

-

Hi-Test Company uses the weighted-average method of process costing to assign production costs to its products. Information for September follows. Assume that all materials are added at the beginning...

-

Explain forms of employee flexibility and discuss the extent to which they are implemented in practice LO5

-

ANALYSIS OF PROFITABILITY Based on the financial statement data in Exercise 24-1B, compute the following profitability measures for 20-2 (round all calculations to two decimal places): (a) Profit...

-

Eddie wants to cash in his winning lottery ticket. He can either receive ten, $100,000 semiannual payments starting today, or he can receive a lump-sum payment now based on a 6% annual interest rate....

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

Which of the following correctly describes how to report cash? a. Restricted cash is always reported as a current asset. b. Cash can be combined with cash equivalents. c. Cash can be combined with...

-

A company bundles a product and service that separately sell for $40 and $60, respectively. If the bundled price is $80, how much revenue is recognized for delivering the product? a. $32 b. $40 c....

-

Refco Inc. failed to disclose in SEC filings that millions of dollars of its accounts receivables were uncollectible. Two months after its IPO, the company went bankrupt. Shareholders filed suit...

-

Write a query that will return sales details of all customers and products. The query should return all customers, even customers without invoices and also all products, even those products that were...

-

Listed below are measured amounts of caffeine (mg per 12oz of drink) obtained in one can from each of 14 brands. Find the range, variance, and standard deviation for the given sample data. Include...

-

Early in 2025, Bonita Equipment sold 600 Rollomatics at $5,500 each. During 2025, Bonita spent $19,000 servicing the 2-year assurance warranties with inventory, cash, and payables that accompany the...

-

On December 1, Year 1, Wayne and Susan Li formed a corporation called French Broad Equipment Rentals. The new corporation was able to begin operations immediately by purchasing the assets and taking...

-

a street light is at the top of a 25 ft pole. A 5 ft girl walks along a straight path away from the pole with a speed of 3 ft/sec. At what rate is the tip of the shadow moving away from the light...

-

Whiskey Industries Ltd., a Nanaimo, British Columbiabased company, has a December 31 year end. The companys comparative statement of financial position and its statement of income for the most recent...

-

(a) Bright Sdn Bhd (BSB) is a tax resident manufacturing company in Johor, which involves in ceramic tiles. Currently, BSBs annual sales turnover has been forecasted to be around RM 300,000 for the...

-

Under accrual basis accounting, expenses are recognized when incurred, which means the activity giving rise to the expense has occurred. Assume the following transactions occurred in January: a. Dell...

-

Under accrual basis accounting, expenses are recognized when incurred. The following transactions occurred in January: a. American Express paid its salespersons $ 3,500 in commissions related to...

-

The following transactions occurred during a recent year: a. Paid wages of $ 1,000 for the current period (example). b. Borrowed $ 5,000 cash from local bank using a short- term note. c. Purchased $...

-

Accounting changes fall into one of three categories. Identify and explain these categories and give an example of each one.

-

Machinery is purchased on May 15, 2015 for $120,000 with a $10,000 salvage value and a five year life. The half year convention is followed. What method of depreciation will give the highest amount...

-

Flint Corporation was organized on January 1, 2020. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 514,000 shares of no-par common stock with a stated value of $2...

Study smarter with the SolutionInn App