Vulcanzap Inc. (VZAP) is a high-technology company that develops, designs, and manufactures telecommunications equipment. VZAP was founded

Question:

Vulcanzap Inc. (VZAP) is a high-technology company that develops, designs, and manufactures telecommunications equipment. VZAP was founded in 2012 by the former assistant head of research and development at a major telephone company, Dr. Alexa Zander. She and the director of marketing left the company to found VZAP. VZAP has been very successful. Sales reached $8.3 million in its first year and have grown by 80% annually since then. The key to VZAP’s success has been the sophisticated software contained in the equipment it sells.

VZAP’s board of directors recently decided to issue shares to raise funds for strategic objectives through an initial public offering of common shares. The shares will be listed on a major Canadian stock exchange. VZAP’s underwriter, Mitchell Securities, believes that an offering price of 18 to 20 times the most recent fi scal year’s earnings per share can be achieved. This opinion is based on selected industry comparisons.

VZAP has announced its intention to go public, and work has begun on the preparation of a preliminary prospectus. It should be filed with the relevant securities commissions in 40 days. Th e offering is expected to close in about 75 days. The company has a July 31 year end. It is now September 8, 2017. You, CPA, work for Olariu Chathan, Chartered Professional Accountants, the auditors of VZAP since its inception.

You have just been put in charge of VZAP’s audit, due to the sudden illness of the senior. VZAP’s yearend audit has just commenced. At the same time, VZAP’s staff and the underwriters are working 15-hour days trying to write the prospectus, complete the required legal work, and prepare for the public off ering. Th e client says that the audit must be completed so that the financial statements can go to the printer in 22 days. VZAP plans to hire a qualified chief fi nancial officer as soon as possible.

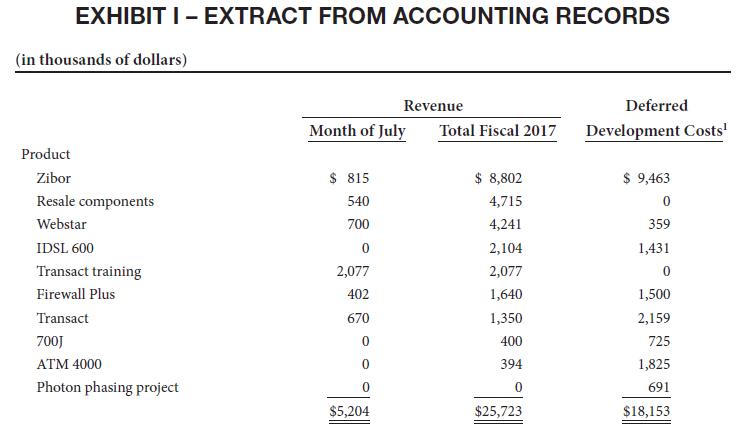

An extract from VZAP’s accounting records is found in Exhibit I. You have gathered the information in Exhibit II from the client, and your staff has gathered the information in Exhibit III. You have been asked by the audit partner to prepare a memo dealing with the key financial accounting issues.

Required Prepare the memo.

EXHIBIT II – INFORMATION GATHERED FROM THE CLIENT 1.

The job market for top soft ware and hardware engineering talent is very tight. As a result, VZAP has turned to information technology “head hunters” to attract key personnel from other high-technology companies. During the year, VZAP paid $178,000 in placement fees, and the company is amortizing the payments over five years. The search fi rm offers a one-year money-back guarantee if any of the people hired leaves the company or proves to be unsatisfactory.

2.

On July 29, 2017, the company made a payment of $100,000 to a computer hacker. The hacker had given the company 10 days to pay her the funds. Otherwise, she said she would post a security fl awshe had detected in the VZAP’s Firewall Plus software, on the Internet.

3.

Alexa Zander had been working on a photon phasing project when she left the telephone company.She has moved this technology ahead signifi cantly at VZAP, and a prototype was built at a cost of $691,000. The project has been delayed pending a decision on the direction it will take.

4.

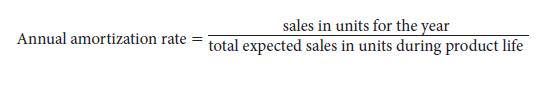

VZAP defers and amortizes software and other development costs using the following formula:

5.

In line with normal software company practice, VZAP releases software upgrades that correct certain bugs in previously released software, via the Internet.

6.

During a routine visit to the AC&C Advanced Telecommunications laboratory in southern California, a VZAP engineer discovered that nearly 600 lines of code in an AC&C program were identical to those of some VZAP software written in 2015—right down to two spelling mistakes and a programming error.

7.

The ATM 4000 has been the company’s only product flop. High rates of field failures and customer dissatisfaction led VZAP to issue an offer, dated July 30, 2017, to buy back all units currently in service for a total of $467,500. Southwestern Utah Telephone is suing VZAP for $4 million for damages related to two ATM 4000 devices that it had purchased through a distributor. The devices broke down, affecting telephone traffic for two weeks before they were replaced.

8.

VZAP also resells components manufactured by a Japanese company. Th e effort required to makethese sales to existing customers is minimal, but the gross margin is only 12% versus an average of 60% for the company’s other products, excluding the Transact and 700J lines.

9.

During its first two years, VZAP expensed all desktop computers when purchased, on the grounds that they become obsolete so fast that their value after one year is almost negligible. In the current year, VZAP bought $429,000 worth of PCs and plans to write them off over two years.

10.

Revenue is recognized on shipment for all equipment sold. Terms are FOB VZAP’s shipping location.

11.

VZAP’s Director of Marketing, Albert Brezar, has come up with a novel method of maximizing profits on the Transact product line. Transact is one of the few VZAP products that has direct competition. Transact routes telephone calls 20% faster than competing products but sells for 30% less. VZAP actually sells the product at a loss. However, without a special training course off ered byVZAP, fi eld efficiency cannot be maximized. Customers usually realize that they need the special training a couple of months after purchase. Albert estimates that the average telephone company will spend three dollars on training for every dollar spent on the product. Because of the way telephone companies budget and account for capital and training expenditures, most will not realize that they are spending three times as much on training as on the product.

Step by Step Answer:

Canadian Financial Accounting Cases

ISBN: 9781119277927

2nd Canadian Edition

Authors: Camillo Lento, Jo Anne Ryan