10-17A. (BAAs) The Andrzejewski Corporation is considering two mutually exclusive projects, one with a three-year life and...

Question:

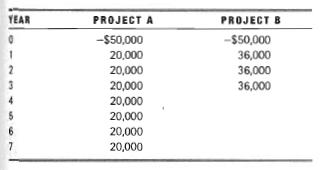

10-17A. (BAAs) The Andrzejewski Corporation is considering two mutually exclusive projects, one with a three-year life and one with a seven-year life. The after-tax cash flows from the two projects are as follows:

a. Assuming a 10 percent required rate of return on both projects, calculate each project's EAA. Which project should be selected?

b. Calculate the present value of an infinite-life replacement chain for each project.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.

Question Posted: