11. Caledonia is considering two invesnnents with one-year lives. The more expensive of the two is the

Question:

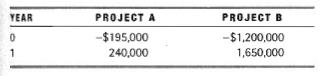

11. Caledonia is considering two invesnnents with one-year lives. The more expensive of the two is the better and will produce more savings. Assume these projects are mutually exclusive and that the required rate of return is 10 percent. Given the following after-tax net cash flows:

a. Calculate the net present value.

b. Calculate the profitability index.

c. Calculate the internal rate of return.

d. If there is no capital-rationing constraint, which project should be selected? If there is a capital-rationing constraint, how should the decision be made?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.

Question Posted: