11-6A. (Certainty equivalents) Nacho Nachtmann Company uses the certainty equivalent approach when it evaluates risky investments. The...

Question:

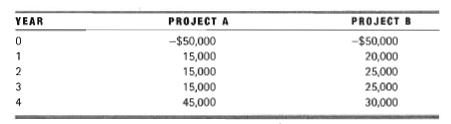

11-6A. (Certainty equivalents) Nacho Nachtmann Company uses the certainty equivalent approach when it evaluates risky investments. The company presently has two mutually exclusive investment proposals with an expected life of four years each to choose from with money it received from the sale of part of its toy division to another company. The expected net cash flows are as follows:

The certainty equivalent coefficients for the net cash flows are as follows:

Which of the two investment proposals should be chosen, given that the after-tax risk-free rate of return is 6 percent?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.

Question Posted: