13-2A. (Free cash flow model valuation) The Berginan Corporation sold its shares to the general public in

Question:

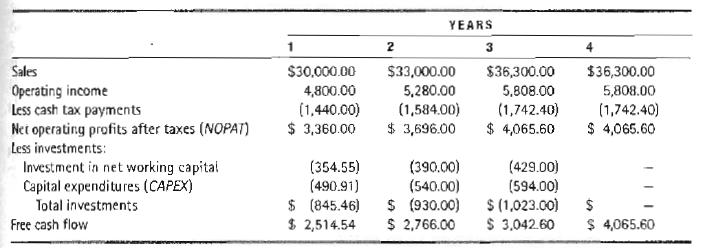

13-2A. (Free cash flow model valuation) The Berginan Corporation sold its shares to the general public in 2003. The firm's estimated free cash flows for the next four years are as follows:

Bergmau estimated that its free cash flows would form a level perpetuity beginning in year 4. Furthermore, the firm's investment banker conducted a study of the firm's cost of capital and estimated the weighted average cost of capital to be approximately 12 percent.

a. What is the value of Bergman using the free cash-flow valnation model?

b. Given that Bergman's invested capital in year 0 is $9,818.18, what is the market value added for Bergman?

c. If Bergman has 2,000 shares of common stock outstanding and liabilities valued at $4,000, what is the valne per share of its stock?

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.