13-3A. (Calculating economic value added) The management of the Bergman Corporation (from problem 13-2A) wishes to estimate

Question:

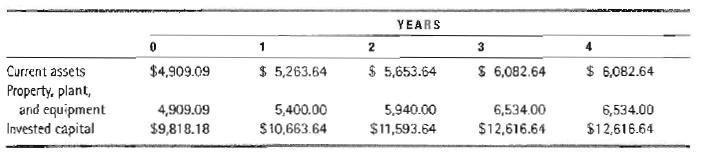

13-3A. (Calculating economic value added) The management of the Bergman Corporation (from problem 13-2A) wishes to estimate EVA for each of the next three years of the firm's operations. An evaluation of the firm's invested capital reveals the following values beginning with the cur- rent period (year 0):

a. Calculate Bergman's EVAs for years 1 through 4. What do these valnes tell you about the value being created by Bergman?

b. What is Bergmau's return ou invested capital (ROIC) for each of the years 1 through 4? Relate the firm's ROIC to your EVA estimates.

c. Bergman's EVAs for years 4 and beyond form a level perpetuity equal to the EVA for year 3. Calculate the present value of the firm's EVAS for years 1 through infinity. How does this present value compare to the market value added for the firm (see part of problem 13-2A)? You can assume that the free cash-flow value of Bergman from problem 13-2a is $30,730.95.

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.