13-3B. (Calculating economic value added) The management of the Hackberg Corporation (from problem 13-2B) wishes to estimate

Question:

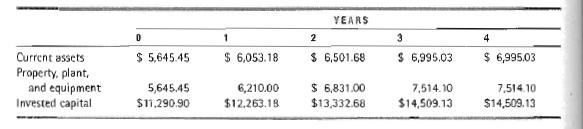

13-3B. (Calculating economic value added) The management of the Hackberg Corporation (from problem 13-2B) wishes to estimate EVA for each of the next four years of the firm's operations. An evaluation of the firm's invested capital reveals the following values beginning with the cur- rent period (year 0):

a. Calculate Hackberg's EVAS for years 1 through 4. What do these values tell you about the valne being created by Hackberg?

b. What is Hackberg's return on invested capital (ROIC) for each of the years 1 through 4? Relate the firm's ROIC to your EVA estimates.

c. Hackberg's EVAs for years 4 and beyond formi a level perpetuity equal to the EVA for year 3. Calculate the present value of the firm's EVAs for years 1 through infinity. How does this present value compare to the market value added for the firm (see part b of problem 13-2B)? You can assume that the free cash-flow value of Hackberg from prob- lem 13-2B is $30,513.88.

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.