17-6B. (Long-term residual dividend policy) Wells Manufacturing, Inc., has projected its investment opportunities over a five-year planning

Question:

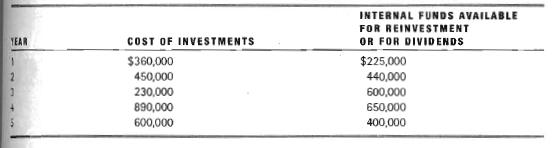

17-6B. (Long-term residual dividend policy) Wells Manufacturing, Inc., has projected its investment opportunities over a five-year planning horizon. The cost of each year's investment and the amount of internal funds available for reinvestment for that year follow. The firm's debt-equity mix is 40 percent debt and 60 percent equity. There are currently 125,000 shares of common StOCk outstanding.

a.ı What would be the dividend each year if the residual dividend theory were used on a year-to-year basis?

b.ı What target stable dividend can Wells establish by using the long-term residual dividend theory over the future planning horizon?

c.ı Why might a residual dividend policy applied to the five years as opposed to individual years be preferable?

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.