9. Caledonia is considering an additional investment project with an expected life of two years and would

Question:

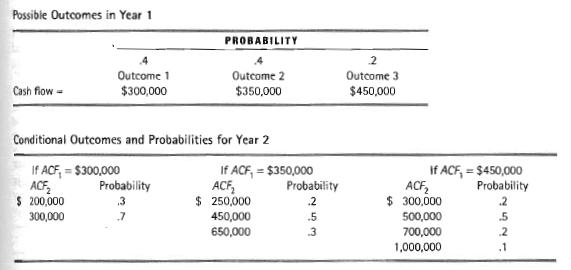

9. Caledonia is considering an additional investment project with an expected life of two years and would like some insights on the level of risk this project has using the probability tree method. The initial outlay on this project would be $600,000, and the resultant possible cash flows are as follows:

a. Construct a probability tree representing the possible outcomes.

b. Determine the joint probability of each possible sequence of events taking place.

c. What is the expected IRR of this project?

d. What is the range of possible IRRs for this project?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.

Question Posted: