CORPORATE VALUATION Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash

Question:

CORPORATE VALUATION Dozier Corporation is a fast-growing supplier of office products.

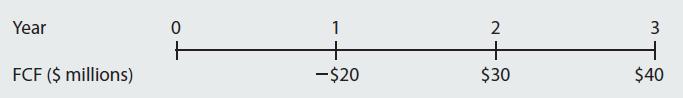

Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dozier’s WACC is 13%.

a. What is Dozier’s horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.)

b. What is the firm’s value today?

c. Suppose Dozier has $100 million of debt and 10 million shares of stock outstanding.

What is your estimate of the current price per share?AppendixLO1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Financial Management Concise Edition

ISBN: 9781285065137

8th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: