Jason Jeffries was still a bit stunned as he pressed the lever on the water cooler just

Question:

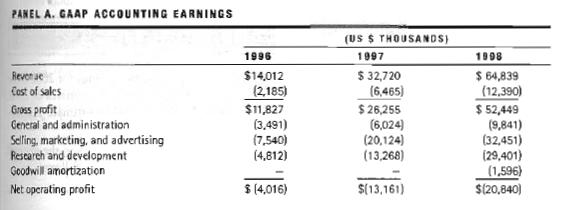

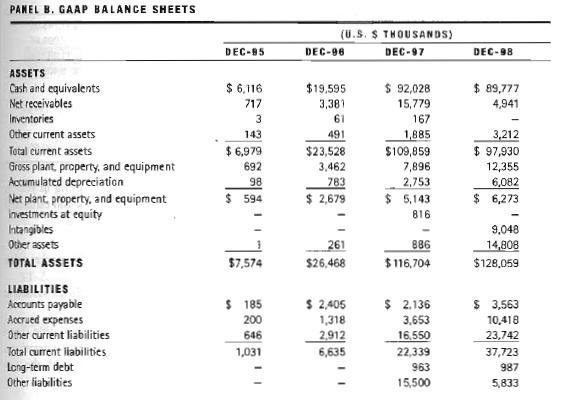

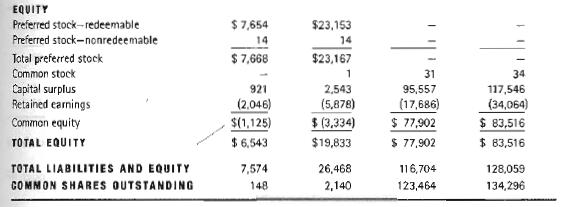

Jason Jeffries was still a bit stunned as he pressed the lever on the water cooler just outside his boss's office. Just minutes before, Jason had left the office of Sarah Burchette, a partner at Performance Plus and Jason's immediate supervisor. During their brief visit, Sarah had informed him that the firm wanted to broaden its practice to include new-economy Internet firms. To get the ball rolling for the firm's new target inarket, she asked Jason to work up a performance analy- sis for RealNetworks Inc. and present it to the company's partners in two weeks. This meant that Jason would have to come to grips with just how much value RealNetworks was creating and how it was doing it. Jason was thrilled with the opportunity to lead the effort but very concerned that he would not have enough time to come up with anything meaningful. After all, rationalizing the market valuations of Internet firms was not easy even to the most savvy investors. After graduating with an MBA from a well-known university in the southwestern United States, Jason had joined the staff of a regional consulting firm, PerformancePlus, where he entered the firm's practice as an associate with a specialty in finance. PerformancePlus specializes in the design of compensation programs that provide greater employee incentives to create shareholder value. The principal tool used in its performance appraisal practice is economic value added, or EVA, which was developed by Stern Stewart and Company. RealNetworks Inc. is a Washington corporation that provides software products for "streaming" audio, video, text, animation, and other media content over the Internet. Its prod- ucts include RealAudio and RealVideo. The leadership of the firm, and inany industry watchers, believe that streaming media technology is essential to the evolution of the World Wide Web as a mass communications medium because it allows the Internet to compete more effectively with traditional media. 21 The historical performance of RealNetworks is similar to that of many other new economy Internet firms. The company has experienced very rapid sales growth but has yet to produce a profit (see Panel A of Exhibit 1). In fact, the firm has experienced increasing losses in every year; in 1998, the firm lost over $20 million. In spite of these continued and growing losses, RealNetworks's stock price closed just under $9 per share in 1998, giving the firm a market cap- italization of $1,204,467.

a. Evaluate RealNetworks' profitability over the 1996-1998 period.

b. What do you think is the appropriate number for RealNetworks' invested capital at the end of 1998? Note that both marketing and R&D expenditures are expensed fully against revenues in the year in which the expenditures are made. Do you think that this distorts total assets as an indication of the firm's invested capital? Explain.

c. Explain how you would go about evaluating the EVA for 1996-1998. What problems do you see in carrying out the analysis?

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.