MANAGING CURRENT ASSETS Dan Barnes, financial manager of Ski Equipment Inc. (SKI), is excited, but apprehensive. The

Question:

MANAGING CURRENT ASSETS Dan Barnes, financial manager of Ski Equipment Inc. (SKI), is excited, but apprehensive. The company’s founder recently sold his 51% controlling block of stock to Kent Koren, who is a big fan of EVA (Economic Value Added). EVA is found by taking the after-tax operating profit and subtracting the dollar cost of all the capital the firm uses:

EVA EBIT 1 − T − Annual dollar cost of capital EBIT 1 − T − WACC Capital employed If EVA is positive, the firm is creating value. On the other hand, if EVA is negative, the firm is not covering its cost of capital and stockholders’ value is being eroded. Koren rewards managers handsomely if they create value, but those whose operations produce negative EVAs are soon looking for work. Koren frequently points out that if a company can generate its current level of sales with fewer assets, it will need less capital. That would, other things held constant, lower capital costs and increase EVA.

Shortly after he took control, Koren met with SKI’s senior executives to tell them his plans for the company. First, he presented some EVA data that convinced everyone that SKI had not been creating value in recent years. He then stated, in no uncertain terms, that this situation must change. He noted that SKI’s designs of skis, boots, and clothing are acclaimed throughout the industry but that other aspects of the company must be seriously amiss. Either costs are too high, prices are too low, or the company employs too much capital; and he expects SKI’s managers to identify and correct the problem.

Barnes has long believed that SKI’s working capital situation should be studied—the company may have the optimal amounts of cash, securities, receivables, and inventories; but it may also have too much or too little of these items. In the past, the production manager resisted Barnes’s efforts to question his holdings of raw materials inventories, the marketing manager resisted questions about finished goods, the sales staff resisted questions about credit policy (which affects accounts receivable), and the treasurer did not want to talk about her cash and securities balances. Koren’s speech made it clear that such resistance would no longer be tolerated.

Barnes also knows that decisions about working capital cannot be made in a vacuum. For example, if inventories could be lowered without adversely affecting operations, less capital would be required, the dollar cost of capital would decline, and EVA would increase. However, lower raw materials inventories might lead to production slowdowns and higher costs, while lower finished goods inventories might lead to the loss of profitable sales. So before inventories are changed, it will be necessary to study operating as well as financial effects. The situation is the same with regard to cash and receivables.

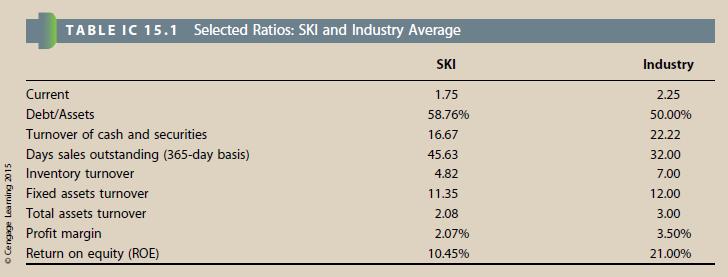

a. Barnes plans to use the ratios in Table IC 15.1 as the starting point for discussions with SKI’s operating executives. He wants everyone to think about the pros and cons of changing each type of current asset and the way changes would interact to affect profits and EVA. Based on the data in Table IC 15.1, does SKI seem to be following a relaxed, moderate, or restricted current assets investment policy?

b. How can we distinguish between a relaxed but rational current assets investment policy and a situation where a firm has a large amount of current assets due to inefficiency? Does SKI’s current assets investment policy seem appropriate? Explain.

c. SKI tries to match the maturity of its assets and liabilities. Describe how SKI could adopt a more aggressive or a more conservative financing policy.

d. Assume that SKI’s payables deferral period is 30 days. Now calculate the firm’s cash conversion cycle estimating the inventory conversion period as 365/Inventory turnover.

e. What might SKI do to reduce its cash and securities without harming operations?

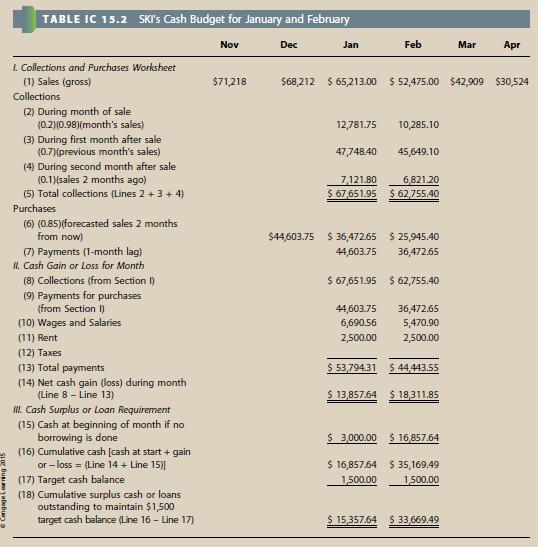

In an attempt to better understand SKI’s cash position, Barnes developed a cash budget. Data for the first 2 months of the year are shown in Table IC 15.2. (Note that Barnes’s preliminary cash budget does not account for interest income or interest expense.) He has the figures for the other months, but they are not shown in Table IC 15.2.

f. In his preliminary cash budget, Barnes has assumed that all sales are collected and, thus, that SKI has no bad debts. Is this realistic? If not, how would bad debts be dealt with in a cash budgeting sense?

(Hint: Bad debts affect collections but not purchases.)

g. Barnes’s cash budget for the entire year, although not given here, is based heavily on his forecast for monthly sales. Sales are expected to be extremely low between May and September but then increase dramatically in the fall and winter. November is typically the firm’s best month, when SKI ships equipment to retailers for the holiday season. Interestingly, Barnes’s forecasted cash budget indicates that the company’s cash holdings will exceed the targeted cash balance every month except October and November, when shipments will be high but collections will not be coming in until later. Based on the ratios in Table IC 15.1, does it appear that SKI’s target cash balance is appropriate? In addition to possibly lowering the target cash balance, what actions might SKI take to better improve its cash management policies and how might that affect its EVA?

h. Is there any reason to think that SKI may be holding too much inventory? If so, how would that affect EVA and ROE?

i. If the company reduces its inventory without adversely affecting sales, what effect should this have on the company’s cash position (1) in the short run and (2) in the long run? Explain in terms of the cash budget and the balance sheet.

j. Barnes knows that SKI sells on the same credit terms as other firms in the industry. Use the ratios presented in Table IC 15.1 to explain whether SKI’s customers pay more or less promptly than those of its competitors. If there are differences, does that suggest that SKI should restrict or relax its credit policy? What four variables make up a firm’s credit policy, and in what direction should each be changed by SKI?

k. Does SKI face any risks if it restricts its credit policy? Explain.

l. If the company reduces its DSO without seriously affecting sales, what effect will this have on its cash position (1) in the short run and (2) in the long run? Answer in terms of the cash budget and the balance sheet. What effect should this have on EVA in the long run?

m. Assume that SKI buys on terms of 1 10, net 30, but that it can get away with paying on the 40th day if it chooses not to take discounts. Also assume that it purchases $3 million of components per year, net of discounts.Howmuch free trade credit can the company get, howmuch costly trade credit can it get, and what is the percentage cost of the costly credit? Should SKI take discounts? Why or why not?

n. Suppose SKI decided to raise an additional $100,000 as a 1-year loan from its bank, for which it was quoted a rate of 8%. What is the effective annual cost rate assuming simple interest and add-on interest on a 12-month installment loan?AppendixL01

Step by Step Answer:

Fundamentals Of Financial Management Concise Edition

ISBN: 9781285065137

8th Edition

Authors: Eugene F. Brigham, Joel F. Houston